Treasury tasks ITA to sort out digital business taxation format

ACADEMICS at the Institute of Tax Administration (ITA) have been tasked to conduct targeted research to help the government address challenges of taxing online and international businesses.

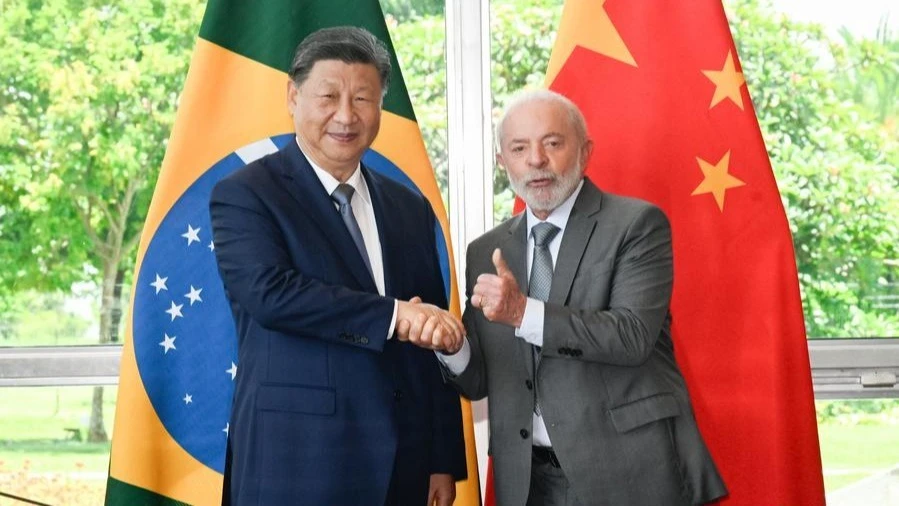

Elijah Mwandumbya, the Treasury deputy permanent secretary, said in an address at the 17th graduation ceremony at the institute’s premises in Dar es Salaam yesterday, underlining the government’s wish to close revenue gaps and combating tax evasion in the evolving digital economy.

There are significant revenue losses the government concedes in online and international business activities, he said, in remarks the top official attributed to the minister, Dr Mwigulu Nchemba.

“We hope the research findings, when taken up as regulatory changes, will help reduce tax evasion and address revenue gaps faced by the government,” he said, expressing confidence that ITA research would provide clear guidelines for regulating the specific sub-sectors.

In other remarks, he urged the Tanzania Revenue Authority (TRA) to enhance tax literacy among the public as a means of enhancing compliance when broadening the tax base.

He asked the graduates to seize opportunities in emerging industries, commercial enterprises and the minerals sector to generate income, while Prof Henry Chalu, the chairman of the governing council, pointed at the importance of collaboration in achieving optimal tax compliance.

He urged private sector firms to hire tax experts to streamline the payment process and minimize errors, also challenging ITA graduates to conduct impactful research that would support the revenue body in expanding the tax base and reducing tax evasion.

Yusuph Mwenda, the TRA director-general, stressed the critical role of integrating science and technology into training programmes at ITA, urging experts there to develop innovative tax systems, identify new revenue streams and address tax evasion gaps.

He highlighted the need for evidence-based solutions since tax reductions are often proposed but few offer data-supported alternatives to generate revenue.

ITA rector Prof Isaya Jairo showcased the institute's contributions to strengthening revenue collection systems across Africa, highlighting that this year 417 graduates received qualifications in various fields.

One is the East African customs and freight forwarding practicing certificates (195 graduates), basic technician certificates in customs and tax management (28 graduates) and diplomas in customs and tax management (61 graduates).

Others are bachelor’s degrees in customs and tax management (119 graduates) and postgraduate diplomas in taxation (14 graduates).

He highlighted ITA’s growing influence through partnerships with Somaliland, Zanzibar, Botswana and Malawi, noting that the institute serves as a hub for advancing tax systems by combining conceptual insights with practical training to meet the demands of the profession.

Top Headlines

© 2024 IPPMEDIA.COM. ALL RIGHTS RESERVED