Lender vows to improve Tanzanians’ livelihoods

DCB Commercial Bank has announced that it will continue to uphold its founding principles, which include supporting sustainable projects aimed at poverty reduction, community development, and providing high-quality services, while boasting about issuing loans exceeding 740bn/- since its establishment.

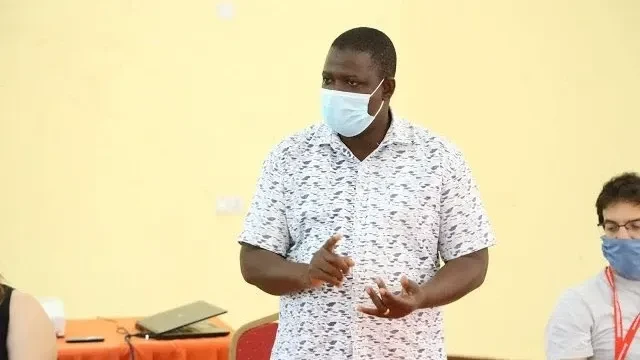

Sabasaba Moshingi, bank’s CEO unveiled this in Dar es Salaam over the weekend when speaking during 22nd Shareholders Annual General Meeting.

He stated that since the bank’s founding nearly 22 years ago, it has continued to grow year after year, offering different solutions to customers from all sectors, proving that DCB is indeed a "True Liberator" for Tanzanians' livelihoods.

Moshingi emphasized that the bank is proud to be a leader in addressing the issue of business capital for small entrepreneurs by introducing innovative products using modern technologies that align with global scientific and technological advancements.

“DCB Commercial Bank has been at the forefront of providing loans to small entrepreneurs who face challenges in accessing such services from other financial institutions due to not meeting their requirements. We have also continued to excel in offering personal loans and group loans for entrepreneurs, and we have consistently improved these loans to meet their needs. Over the 22 years since DCB was founded, we are proud to have provided loans worth more than 741bn/-, benefiting more than 420,000 Tanzanians,” he said.

“Although we didn’t perform well last year due to various challenges, such as the withdrawal of some deposits from local government authorities, non-performing loans caused by the fake certificate scandal affecting many government employees, and the COVID-19 pandemic, we are now rewriting the bank’s history. Thanks to several measures we have taken, success has begun to be seen in the first two quarters of this year,” Moshingi added.

The CEO stated that one of the steps taken as part of rewriting DCB’s history is the launch of a five-year strategic plan from 2023 to 2028.

He outlined the objectives of this plan, which include increasing the bank’s capital from 16bn/- to 61bn/-, in line with the legal requirement set by the Bank of Tanzania (BoT). Some actions to achieve this include launching a share sale initiative for both old and new shareholders.

Other goals include increasing the bank’s deposits, expanding the number of branches, growing the loan portfolio, and reducing the non-performing loan (NPL) ratio from 4.7 percent to below 4.4 percent. Lastly, the plan aims to ensure that DCB’s services reach ordinary citizens everywhere, in line with the bank's founding purpose.

He also mentioned the bank's special service called "Tausi," targeting women entrepreneurs by providing loans to support their businesses, offering financial education, and providing business management strategies.

“This loan program, particularly aimed at women, has been highly successful in empowering women economically. So far, more than 250bn/- has been provided, benefiting over 4,000 women,” said the CEO.

Moshingi added that, apart from women’s loans, DCB has also excelled in providing other types of loans, including group loans, housing loans, employee loans (especially for teachers), loans for tricycles, motorcycles, and rickshaws, among others.

“In terms of social services, our bank has also been at the forefront of supporting our government’s efforts, particularly in education and health, through our ongoing projects. This includes the special DCB Skonga education account aimed at improving the education of our children.

“Last year, we donated desks to five schools in all the municipalities of Dar es Salaam under the slogan: ‘Elimu Mpango Mzima na Mama Samia,’ aiming to donate 1,000 desks to various schools across the country between 2023 and 2025. This project is progressing well, and next week, we will be handing over some of these desks at Msisiri B Primary School in Kinondoni, Dar es Salaam,” he stated.

Siriaki Surumbu, DCB’s acting financial director said the bank has continued to grow its revenue by focusing on high-quality lending, especially to women's groups and various entrepreneurs. Improvements in various service departments, especially digital services, are expected to enhance efficiency and increase the bank's income.

Zawadia Nanyaro, chairperson of the DCB board of directors mentioned that the bank has been at the forefront of supporting the sixth-phase government, led by President Samia Suluhu Hassan, in its agenda to ensure banking services reach all Tanzanians. This is being achieved through better and more affordable digital banking services.

Nanyaro also said that the goal of ensuring nationwide access to DCB services is progressing well, supported by the strengthening of services, expansion of the agent network to over 1,000 agents across the country, and 1,500 strategic service centres.

Other objectives include growing customer deposits to reach half a trillion shillings, achieving a cumulative profit of 37bn/-, and improving the bank’s operational efficiency to 54 percent by balancing the bank's operating costs with its revenue.

“I would like to thank our government, under the leadership of our President Samia Suluhu Hassan, for creating an environment that facilitates the financial sector to operate in favourable and enabling conditions. I also appreciate the importance of involving the private sector in various strategic projects successfully being implemented across the country.”

“I would also like to assure our shareholders, customers, and stakeholders that your bank is in safe hands and continues to thrive under the leadership of Moshingi, the management, all employees, and the Board of Directors.

“What we need is cooperation from all of you shareholders, stakeholders, and our customers so that our bank can continue to perform well in the market and achieve all the development strategies we have set.

“I call on all Tanzanians to join our bank and benefit from the various excellent banking services we offer. DCB is the True Liberator for all Tanzanians, small and medium entrepreneurs, women, and youth. DCB is the True Liberator for business people from all sectors,” Nanyaro concluded.

Top Headlines

© 2024 IPPMEDIA.COM. ALL RIGHTS RESERVED