Breaking the paycheck-to-paycheck cycle: How to regain control of your money

Pay check to paycheck is an exhausting cycle that traps millions of hardworking individuals in financial uncertainty. Every end of the month feels like a countdown to zero—waiting for the next salary just to survive. Despite working long hours or even holding multiple jobs, the money always seems to disappear as quickly as it comes in. But breaking this cycle is possible, and it starts with a new mindset and smarter money habits. Understanding the Cycle The paycheck-to-paycheck lifestyle means your income is barely enough to cover your monthly expenses, with little or nothing left for savings. It often leaves no cushion for emergencies, no room to breathe, and no path toward long-term financial freedom. Many people fall into this cycle not because they’re lazy or irresponsible, but because they’ve never been taught the principles of budgeting, saving, and managing financial priorities.

Step 1: Know Where Every Shilling Goes

The first and most critical step in regaining control of your finances is tracking your spending. You can’t fix what you don’t fully understand. For at least 30 consecutive days, record every single expense—no matter how small. This includes your rent, electricity bills, bus fare, airtime, snacks, mobile data, or those casual weekend outings. Every coin counts. To organize this process, use a method that works for you: a simple notebook, a budgeting app, or a spreadsheet.

Then, sort each expense into three main categories: Needs (such as rent, groceries, transport, and medicine), Wants (like entertainment, takeout, or non-essential clothing), and Savings or debt repayment. Once everything is laid out clearly, you may be shocked to discover how much money is slipping through unnoticed leaks—especially on things like daily airtime purchases, impulse food orders, or unplanned mobile subscriptions. This exercise creates awareness, which is the foundation for meaningful financial change.

STEP 2: Check Your Rental Fees and Measure Housing Affordability

An important step in taking control of your finances is evaluating how much of your income goes toward rent. This is done by calculating your rent-to-income ratio, which shows what percentage of your monthly income is being spent on housing. To calculate it, divide your monthly rent by your total monthly income (before taxes) and multiply the result by 100. For example, if you earn TZS 800,000 per month and pay TZS 300,000 in rent, your rent-to-income ratio is 37.5%.

This is higher than the recommended guideline. Financial experts suggest that rent should not exceed 30% of your gross monthly income. Spending more than this can lead to rent stress, leaving little room for essentials like food, transport, savings, or debt repayment. If your rent takes up too much of your income, consider downsizing to a more affordable space, relocating to a less expensive area, sharing housing with others to split costs, or negotiating a lower rent with your landlord. Keeping your housing costs within a healthy range is essential for long-term financial stability and for breaking free from the paycheck-to-paycheck cycle.

Step 3: Build a Realistic Budget

Once you’ve tracked your spending and have a clear picture of where your money goes, the next step is to create a budget that aligns with your actual income and lifestyle—not an idealized version of it. A practical and widely used budgeting method is the 50/30/20 rule, which divides your monthly income into three key categories: 50% for needs (such as rent, food, transport, and utilities), 30% for wants (such as dining out, entertainment, or hobbies), and 20% for savings or debt repayment.

However, this guideline is not rigid—if your income is modest or irregular, you may need to adjust the percentages. Even saving as little as 5–10% each month can make a significant difference over time. The goal is to prioritize your non-negotiable expenses while identifying areas to trim, such as unused subscriptions, frequent impulse purchases, or costly transportation habits. A realistic, flexible budget not only helps you live within your means but also creates space for saving, investing, and improving your financial stability over time..

Step 4: Create an Emergency Buffer—Even a Small One

Many people stay trapped in the paycheck cycle because they rely on loans or salary advances every time an emergency hits. Start building a mini emergency fund, even if it’s only TZS 20,000 a month. Keep this money separate from your main account to avoid the temptation of spending it. This small buffer will reduce the need for borrowing and give you financial peace of mind.

Step 5: Tackle Debt Strategically

High-interest debts like credit cards or mobile loans make the paycheck-to-paycheck cycle worse. Make a list of all your debts, starting with the smallest or those with the highest interest rates. Use either the snowball method (paying off the smallest debt first) or the avalanche method (targeting the highest interest rate first). As you eliminate debts, redirect those payments toward savings. Avoid taking new unnecessary loans during this time. Consider renegotiating terms or consolidating debts to make them more manageable if possible.

Step 6: Boost Your Income—Even Slightly

Sometimes, budgeting and cutting back on expenses may not be enough to achieve financial stability—especially if your income is already stretched thin. In such cases, finding ways to increase your income becomes essential to create room for saving or paying off debt. This could involve taking up freelance or side gigs such as baking, tutoring, or offering graphic design services. You can also monetize your existing skills or hobbies, or explore part-time work and online opportunities that fit your schedule. Even a small boost—like earning an additional TZS 50,000 per month—can make a meaningful difference over time when consistently directed toward savings or debt repayment. Every extra shilling brings you closer to breaking the cycle of living paycheck to paycheck.

Step 7: Automate Your Progress

Once you begin to stabilize, automate your good habits. Set a standing order to transfer a portion of your income to a savings or investment account as soon as you get paid. Automate bill payments to avoid penalties and improve financial discipline. Automation removes the emotional burden of choosing whether to save—it becomes a default action.

Step 8: Change Your Money Mindset

Breaking the cycle is not just about math, it’s about mindset. Believe that you deserve financial peace and that you can build it one step at a time. Avoid comparing your progress with others. Focus on consistency, not perfection. Practice delayed gratification—the ability to say “not now” to spending so that you can say “yes” to a better financial future.

The Long-Term Payoff

Breaking free from the paycheck-to-paycheck cycle won't happen overnight. It takes discipline, patience, and a willingness to change your approach to money. But the reward is financial independence: the ability to save, to invest, to plan, and to live without fear of the next bill. Remember, even if you're starting with just a single coin, the journey from penny to prosperity begins with action. Every step you take today brings you closer to a future where you control your money instead of your money controlling you.

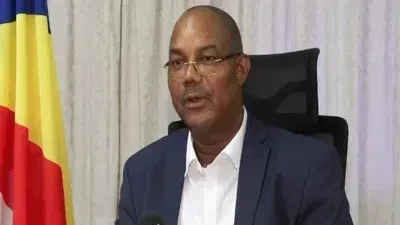

Brighton Ross Kinemo is the Head of Training and Data Sales at the Dar es Salaam Stock Exchange (DSE). He is an Associate Member of the Chartered Institute for Securities and Investment (CISI UK) and an alumnus of several prestigious executive programs.

He completed the Strategic Leadership Programme at the Maastricht School of Management (MSM) in the Netherlands, earned a Certificate in Leadership from Uongozi Institute, and also the Senior Management Development Programme jointly offered by Strathmore Business School and Wits Business School. He can be reached at bross@dse.co.tz.

Top Headlines

© 2025 IPPMEDIA.COM. ALL RIGHTS RESERVED