HOW TO AVOID FINANCIAL NIGHTMARE DURING DIVORCE

Sadly, many people in our society nowadays find themselves the victims of divorce, faced with the harsh realities of a broken marriage. The rising number of divorces in our country in recent years is alarming; According to the State of the National Economy 2024 report, divorce rates have surged by 93.7 percent since 2022.

The same report states that in 2024, the Registration Insolvency and Trusteeship Agency (RITA) registered 866 divorces, compared to 447 in 2022. In Dar es Salaam alone, more than 300 divorces are recorded each month, as reported by Parliament’s Social Services Development Committee. The increase in divorce rates is attributed to factors such as infidelity, behavioral changes, financial issues, marital intimacy problems, greater awareness of women’s rights, and improved financial independence among women.

Going through a divorce is never fun. Not for you, and definitely not for your soon-to-be ex-wife/husband, and definitely not for your kids (if you have them). Divorce is an unfortunate time for all those involved and it affects not only a person’s emotional well-being but their finances as well. The divorce proceedings can be a big challenge on many different levels and the biggest mistake you can make while going through a divorce is making decisions based on emotions. When you are emotional, you don’t think logically and usually make irrational decisions so the best thing you can do throughout the divorce process is to manage your emotions and keep your focus towards achieving your personal and financial goals. This week, I will share a few tips on how to avoid a financial nightmare during divorce which will help you rebuild your life again:

Create A New Budget – A divorce is a major lifestyle change as for a while you lived on two incomes but now you are down to one. Therefore, if you had a budget before, it is time to create a new one and if you didn’t have a budget, it is important to have one as it is the only way to survive the transition and to thrive in your new life. You need to re-evaluate your expenses as your past expenditures cannot fit into your new life of a single income. As a starting point, downsize your expenditures temporarily, stash away any extra money you can, and live on a minimum budget to ensure you are setting a strong budget base for your new life.

Separate Your Finances – This part can be irritating if you have been married for a long time since you will need to reorganize your finances. Your finances include everything from all investments, debts, and liabilities; if you were not involved in your family finances, now is the time to immerse yourself in the details. The first and most important step is to cancel and remove yourself from all joint properties, bank accounts, insurance policies, and loans; anything that has both your names on it needs to be addressed. This will help you to have a clear picture of your financial situation and help you strategize towards your new financial goals.

Get Financial Advice – During a divorce, your partner can engage in dubious activities that will hurt you financially such as moving the funds or selling off assets without your consent. Furthermore, in most marriages, it is a common practice that one spouse tends to manage the majority of finances and this can lead to all sorts of problems during the divorce if you were not the party that managed the shared finances. If that is the case, you will need to step up and educate yourself about managing the finances, which may very likely require you to seek financial advice. You can hire a financial advisor or have someone who can help you understand your investments, assets, and how to manage your liabilities to ensure a smooth transition to your new life.

To summarize, divorce is one of the most stressful life events a person can through so surround yourself with people you trust that can help you get through personally and financially. Through this article, I have shared three tips that will help you regain control of your financials during a divorce: create a new budget, separate your finances, and get financial advice.

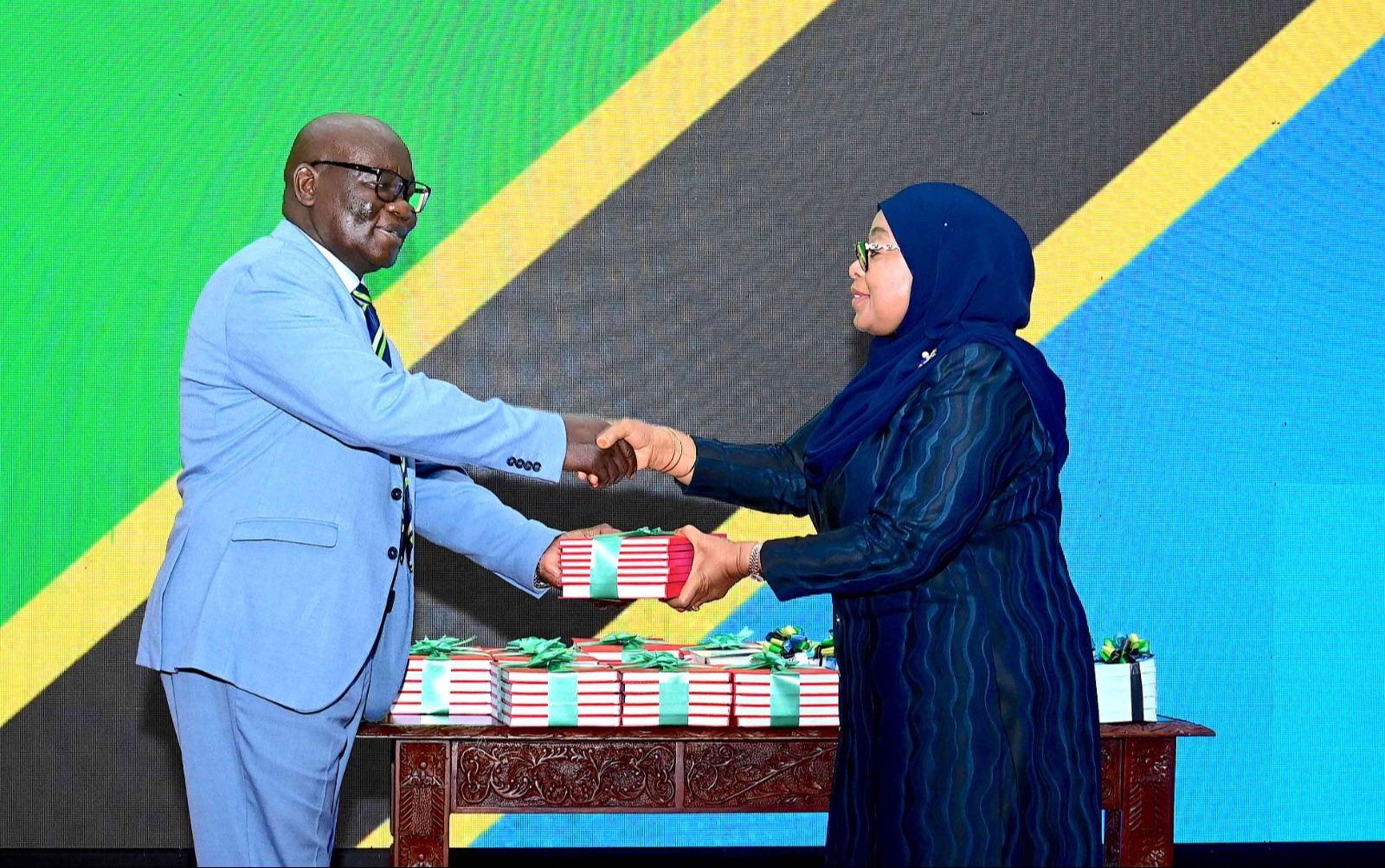

Kelvin Mkwawa, MBA(pictured) is the Seasoned Banker. He can be contacted through Email address: Kelvin.e.mkwawa@gmail.com

Top Headlines

© 2025 IPPMEDIA.COM. ALL RIGHTS RESERVED