Tanzania's external sector shows strong improvement during 2025

Tanzania's external sector continues to exhibit robust performance, reinforcing its economic stability and growth prospects for 2025 and beyond.

According to latest Bank of Tanzania (BoT) and Tanzania Revenue Authority (TRA), the current account deficit has significantly narrowed to US$2,224.9 million in the year ending April 2025, a substantial improvement from US$2,733.4 million in the corresponding period of 2024.

This positive shift is largely attributable to a stronger growth in exports of goods and services compared to imports, as highlighted by recent Bank of Tanzania (BOT) reports.

According to data, foreign exchange reserves reached a healthy US$ 5,307.7 million by the end of April 2025, providing 4.3 months of import cover, comfortably exceeding the country's benchmark of 4 months.

The International Monetary Fund (IMF) further noted that gross international reserves stood at an adequate level of US$ 5.7 billion (about 3.8 months of imports) in March 2025, underscoring improved foreign exchange liquidity.

Export performance

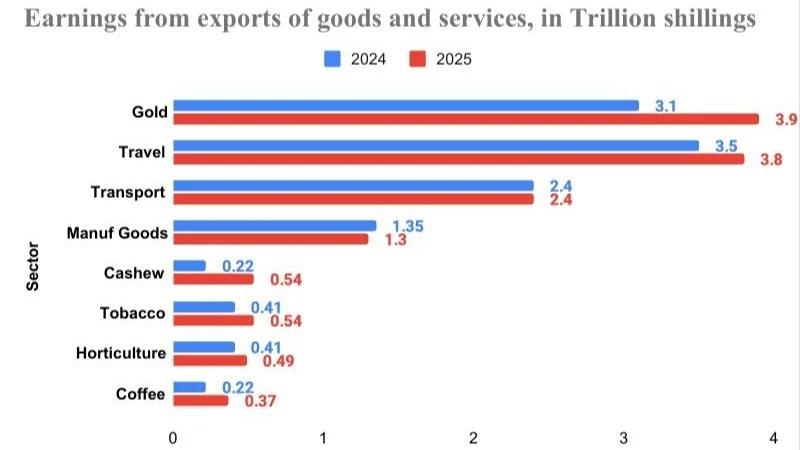

Total exports of goods and services soared by 16.8 percent to US$ 16,684.3 million in the year ending April 2025, up from US$ 14,281.7 million in the previous year. This impressive growth was primarily driven by strong performances in gold, travel (tourism), agricultural products, and transportation services.

Exports of goods, constituting 58.4 percent of total exports, increased to US$ 9,743.5 million from US$ 7,815.8 million, with gold, cashew nuts, coffee, tobacco, and horticultural products leading the way.

Gold

Gold exports experienced a significant surge, reaching US$ 3,900.7 million by April 2025, compared to US$ 3,133.3 million in 2024.

This increase is largely due to favorable global market prices, with some forecasts suggesting gold could surpass $3,000 per ounce in 2025. This robust pricing environment serves as a powerful incentive for increased production.

Companies like TRX Gold anticipate stronger performance in the second half of 2025 at their Buckreef Gold operation, as they gain access to higher-grade ore blocks.

Barrick Gold also forecasts significant gold production, projecting between 150,000 – 180,000 ounces (Barrick's 84 percent share) from its Bulyanhulu mine in 2025.

The World Bank also highlights the mining sector's increased contribution to Tanzania's GDP, reaching 10.1 percent in 2024, surpassing the government's 2026 target, primarily driven by gold.

Agricultural sector

Traditional Exports Flourish Traditional agricultural exports, including cashew nuts, coffee, and tobacco, have shown substantial growth.

For cashew nuts, the Cashew Nut Board of Tanzania (CBT) projected production for the 2024/2025 season to be around 408,600 metric tons, reflecting a 34 percent increase from the previous year.

Some sources indicate even higher figures, with CBT reporting 528,262.23 metric tons** for the 2024/2025 season.

The government has even more ambitious long-term goals, aiming for 700,000 tonnes by the 2025/2026 season and one million tonnes by 2030/2031.

The World Bank emphasizes agriculture's crucial role in inclusive economic growth and rural poverty reduction in Tanzania, with new financing approved to enhance agricultural productivity and climate resilience for hundreds of thousands of farmers.

Tanzania's coffee production in 2025 is also projected to see a notable increase, continuing the positive momentum of recent years. This is driven by favorable weather, ongoing farm rehabilitation efforts, strong international prices, and a supportive government strategy.

The US Department of Agriculture (USDA) forecasts total coffee production to reach 1.45 million 60-kg bags for the 2025/2026 marketing year, an increase from 1.35 million bags in the previous year.

While global coffee prices saw a slight decline in March 2025 due to improved production in Brazil and Vietnam, the overall outlook for Tanzanian coffee remains positive due to domestic factors.

For tobacco, the Tanzanian government has set an ambitious target of 200,000 metric tons for the 2024/2025 agricultural season, a significant increase from approximately 122,858 metric tons produced in 2023/2024.

The government aims to further boost production to 300,000 tons for the 2025/2026 season, with a goal of generating between US$ 600 million and US$ 700 million in annual tobacco export revenues, and a specific target of US$ 667.9 million for the 2024/2025 season.

Tourism sector

The tourism sector is a major driver of Tanzania's economic success. Service receipts rose by 7.3 percent to US$ 6,940.8 million in the year ending April 2025, primarily due to a surge in travel (tourism) receipts, which accounted for 56 percent of total service receipts.

International tourist arrivals significantly increased to 2,162,487 in the year to April 2025 from 1,938,875 in the corresponding period in 2024.

Remarkably, Tanzania outperformed its goal of attracting 5 million international tourists by 2025, welcoming 5.3 million visitors by April of that year. This represents a 7 percent increase over the original target and was achieved three months ahead of the fiscal year's end, underscoring the country's strong appeal as a tourist destination. The country aims to maintain this upward trend.

Tourism's contribution to Tanzania's GDP increased to 17.2 percent in 2024, up from 16.4 percent in 2023, and accounts for a substantial 29 percent of Zanzibar's GDP. The sector directly and indirectly supports over 1.5 million jobs.

Measures such as abolishing park entrance fees for accredited tour guides, reviewing regulatory frameworks, and enhancing security in tourist zones are improving the visitor experience and attracting investors.

While traditional European markets remain strong, there is a growing focus on expanding into new and emerging markets, particularly in Asia (China, India) and other African countries.

Despite this strong performance, the World Bank noted the cancellation of a US$150 million loan for the Resilient Natural Resource Management for Tourism and Growth (REGROW) project in early 2025, which aimed to expand Ruaha National Park.

This cancellation followed concerns over human rights abuses and the project's impact on local communities, highlighting the importance of balancing tourism development with social and environmental sustainability.

Broader economic context, outlook

The IMF has a favorable outlook for Tanzania's economy, with real GDP growth reaching 5.5 percent in 2024 and projected to increase to 6 percent in 2025.

Inflation, at 3.3 percent year-on-year in March 2025, remains subdued and below the Bank of Tanzania's target of 5 percent.

The IMF and Tanzanian authorities recently reached a staff-level agreement on the fifth review under the Extended Credit Facility (ECF) and the second review under the Resilience and Sustainability Facility (RSF), which, once approved, will unlock approximately US$ 441 million in financing.

This support aims to bolster economic resilience, fiscal sustainability, and structural reforms.

Fiscal consolidation is expected to pause in FY2024/25 with a supplementary budget adopted in February 2025 to increase public spending on education, health, and clearance of domestic arrears.

However, authorities are committed to resuming growth-friendly fiscal consolidation in FY2025/26 to preserve debt sustainability.

Efforts to improve the availability and access to finance, streamline business regulations, and strengthen judicial and anti-corruption institutions are key structural reform priorities, as emphasized by both the IMF and World Bank. Continued implementation of climate reforms, supported by the RSF, will also enhance climate resilience and sustainability, crucial for long-term economic stability in Tanzania.

Top Headlines

© 2025 IPPMEDIA.COM. ALL RIGHTS RESERVED