NCBA Strengthens Financial Inclusion and Community Ties Through Ramadan Iftar

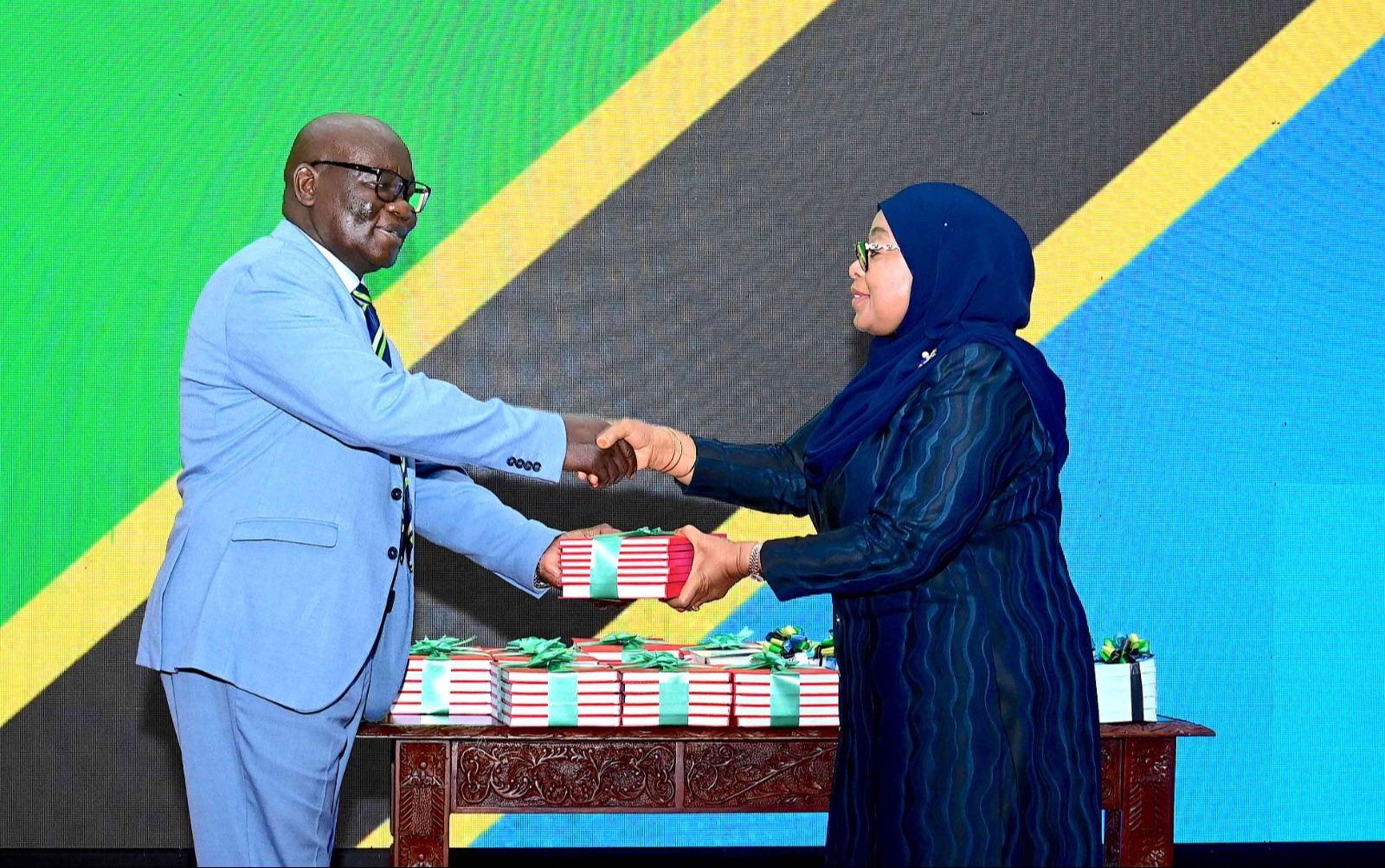

NCBA Bank Tanzania recently hosted a special Iftar dinner at Serena Hotel, bringing together key stakeholders, customers, and religious leaders to celebrate the spirit of Ramadan.

The event underscored the bank’s commitment to fostering financial inclusion and strengthening its ties with the community through innovative financial solutions tailored to meet the diverse needs of individuals and businesses.

Speaking at the event, NCBA Bank Managing Director, Mr. Claver Serumaga, emphasized the bank’s role in enhancing financial accessibility, particularly through digital banking and mobile-

based financial solutions. He highlighted that financial inclusion is key to economic empowerment, and NCBA remains dedicated to ensuring that individuals, regardless of their

background or location, can access essential financial services.

Through platforms like M-Pawa and NCBA Now, the bank continues to transform the banking landscape in Tanzania, making it easier for individuals and businesses to save, access credit, and manage their finances seamlessly.

The event was graced by the Guest of Honor, Deputy Kazh of Tanzania, Sheikh Ally Hamisi Ngeruko, who commended NCBA’s efforts in supporting the Muslim community and advancing

financial inclusion. He highlighted the values of unity, generosity, and economic empowerment during Ramadan, acknowledging NCBA’s role in promoting financial literacy and providing

accessible banking solutions.

He emphasized that financial independence is crucial in fostering a prosperous society and lauded NCBA for offering digital financial solutions that empower

individuals and small businesses.

The Iftar dinner also served as a platform to highlight the growing importance of digital financial solutions in promoting economic resilience. As one of Tanzania’s leading financial institutions, NCBA has been at the forefront of digital transformation, offering a suite of innovative products designed to meet the needs of today’s fast-evolving market.

NCBA Now, the bank’s digital banking platform, allows customers to perform transactions, pay bills, and access financial services seamlessly from their mobile devices. With user-friendly features and real-time banking capabilities, NCBA Now is revolutionizing the way customers interact with their finances.

Understanding the crucial role that small and medium enterprises (SMEs) play in Tanzania’s economy, NCBA has also developed specialized financial solutions tailored for business

owners.

These include working capital financing, trade finance, and asset financing solutions to support business growth and sustainability. Additionally, the bank continues to provide financial

solutions for large corporations and institutions, offering cash management, treasury solutions, and structured lending to ensure businesses have the financial tools needed to scale and

succeed.

The Ramadan Iftar dinner not only provided an opportunity for meaningful engagement with customers and stakeholders but also reinforced NCBA’s commitment to corporate social

responsibility.

Beyond its financial solutions, NCBA remains dedicated to supporting initiatives that enhance financial literacy, promote sustainability, and contribute to the well-being of

communities across Tanzania. Earlier this year, the bank demonstrated its commitment to environmental conservation by planting trees in various regions in Tanzania as part of its

broader 6,000-tree sustainability initiative.

This effort aligns with the bank’s long-term vision of creating a greener and healthier environment for future generations. As NCBA continues to expand its reach across Tanzania, the bank remains steadfast in its mission to enhance financial inclusion, drive economic progress, and support the aspirations of its customers through cutting-edge financial products. Whether through digital banking, SME support, or community-driven initiatives, NCBA is committed to making banking simpler, more efficient, and more accessible to all.

Top Headlines

© 2025 IPPMEDIA.COM. ALL RIGHTS RESERVED