EABL reclaims its position as second largest on DSE

The East African Breweries Limited (EABL) has reclaimed its position as the second largest listed company on the Dar es Salaam Stock Exchange (DSE), after outshining NMB counter.

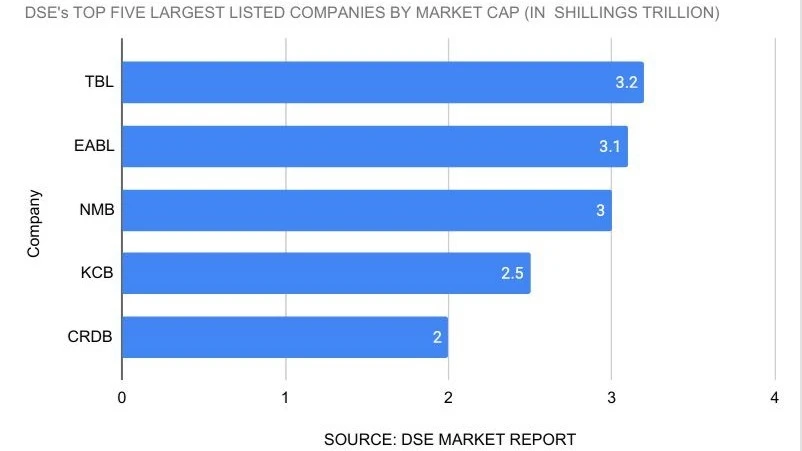

The DSE’s market reports for last week show during the previous week, the Kenyan cross listed company was holding the third position behind Tanzania Breweries Limited (TBL) and NMB counter, which is now holding the third largest.

According to the report, EABL passed NMB on the second largest position, after its market capitalization gained to more than 3trn/- during last week, as it started the week with 3.02trn/- against NMB counter, which has a market cap of 3trn/-.

The increase of EABL market capitalization resulted from the gaining of share price, as it closed the week at 4,040/- on Friday last week, which translated into the market capitalization of 3.15trn/-, which is closer to largest TBL, with NMB counter remaining flat at 3trn/-.

In Kenya, EABL advanced by 1.5 percent w/w to KES174.25, partly attributable to foreign investor exits. It is said to be the market leader in East Africa, commanding significant market share in the beverage sector.

The market reports show TBL has continued to lead the race as its market capitalization is currently at 3.2trn/- with its share price being dormant at 10,900/- per share.

The fourth largest listed company is KCB, which is originally listed at the Nairobi Securities Exchange (NSE), with the market capitalization of 2.5trn/-, followed by CRDB counter, which has a market capitalisation of 2.06trn/-.

Meanwhile, the DSE closed the trading week on a positive note Friday, May 16, 2025, with modest gains buoyed by select counters and sustained investor interest in banking and industrial stocks.

By the end of the trading session, the Tanzania Share Index (TSI) edged up by 1.94 points to settle at 5,009.86, while the broader DSE All Share Index (DSEI) gained 2.85 points, closing at 2,375.06. This slight upward movement underscored growing market confidence, particularly in domestic counters.

Activity on the trading floor showed healthy momentum, with the day recording a total turnover of 649.66m/- from 692,079 shares traded across 868 deals. The market capitalization hovered around 19.83bn/-, reflecting stable valuations among the exchange’s listed equities.

Some of the most notable performances came from Maendeleo Bank (MBP), which rallied by 10 percent, the day’s strongest gainer. The DSE Plc itself rose by 3.70 percent, showing renewed investor optimism in the local bourse operator. Afriprise Investment Plc followed closely, climbing 3.51 percent, while KCB Group and Swissport Tanzania (SWIS) advanced 2.35 percent and 1.33 percent, respectively.

However, a few counters faced downward pressure. Nation Media Group (NMG) led the day’s decliners, sliding 1.89 percent, followed by National Investments Company Limited (NICO) and East African Breweries Limited (EABL), which dropped 1.25 percent and 1.24 percent, respectively.

In terms of trading volume, CRDB Bank maintained its leadership, with 265,846 shares exchanged at a steady price of 790/-. Tanga Cement (TCCL) also saw active movement, closing at 1,760/- on a volume of 186,785 shares. Afriprise Investment traded 162,868 shares, ending the day at 295/-. DCB Commercial Bank (DCB) and NICO rounded off the top trades, exchanging 39,707 and 22,818 shares, respectively.

The overall sentiment on the DSE remained cautiously optimistic. With steady gains in key banking and industrial stocks, investors appear to be selectively rotating into counters with strong fundamentals and growth potential.

As the second quarter unfolds, market watchers will likely keep a close eye on earnings reports and macroeconomic indicators to gauge the direction of the exchange in the coming weeks.

Top Headlines

© 2025 IPPMEDIA.COM. ALL RIGHTS RESERVED