Untaxed, underground: The high cost of gold smuggling, illicit trade

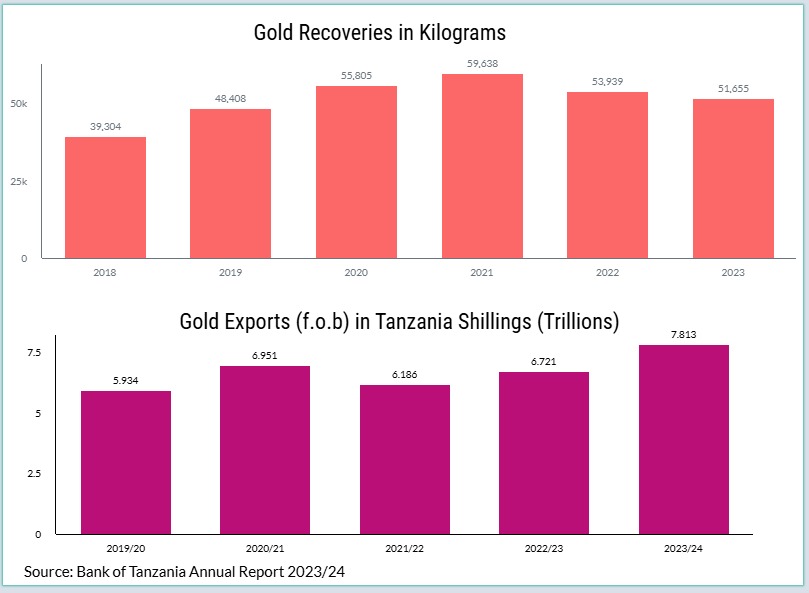

GOLD has become Tanzania’s top foreign exchange earner, surpassing tourism in 2020, according to ENACT Africa. Despite its economic importance, the country continues to lose billions of shillings annually due to large-scale gold smuggling driven by transnational criminal networks.

Government income lost through smuggling could significantly improve essential services like infrastructure projects and socio-economic initiatives. In Tanzania, gold smuggling networks are reportedly run by influential local families, with operations connected to contacts in Kenya, South Africa, and India, according to Tanzania tax specialist Luckystar Miyandazi.

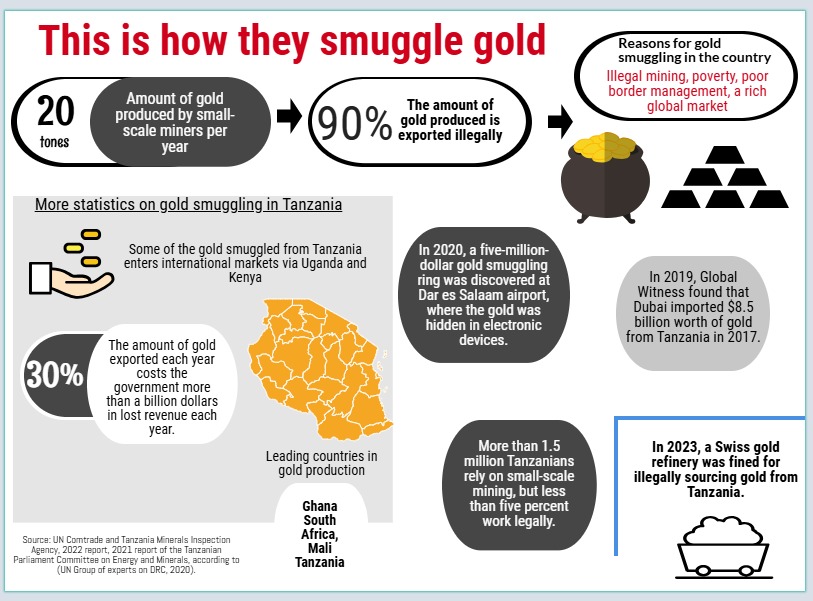

These networks are part of broader illicit financial flows (IFFs) that undermine the potential of the mining sector.Small-scale miners produce around 20 tonnes of gold annually in Tanzania, but an estimated 90 percent of this output is illegally exported.

A 2021 report by the Parliamentary Committee on Energy and Minerals confirmed that most artisanal gold bypasses official channels, evading taxes and royalties. “The statement that small-scale miners produce around 20 tonnes of gold per year, with 90 percent illegally exported, highlights ongoing challenges in the mining sector,” the report noted, emphasizing the impact on regulation and local livelihoods.

Well-organized smuggling networks exploit the gold supply chain's lack of transparency, making it nearly impossible to trace gold’s origin or ensure legal trade. Many artisanal miners, earning as little as $3 per day in regions like Geita and Shinyanga, are lured by smugglers offering 20–30 percent higher prices than official buyers.

Tanzania, the fourth-largest gold producer in Africa after Ghana, South Africa, and Mali, loses about 30 percent of its gold to smuggling annually—equating to over $1 billion (2.6trn/-) in lost revenue, according to a 2022 report by UN Comtrade and the Tanzania Minerals Audit Agency (TMAA).

The scale of smuggling is evident in trade discrepancies. In 2017, Global Witness found Dubai imported $8.5 billion worth of Tanzanian gold, while Tanzania reported only $1.9 billion—just 22 percent of the actual value. In 2020, Swissaid reported that $1.3 billion in Tanzanian gold was smuggled to Dubai.

Smuggling routes often pass through Uganda and Kenya, where enforcement is weaker, according to the UN Group of Experts on the DRC. Methods include concealing gold in toothpaste tubes, electronics, or even dried fish.

In 2021, 543 kilograms of Tanzanian gold were seized in Nairobi, while in 2023, 432 kilograms worth $38 million were intercepted at Julius Nyerere International Airport. Despite government reforms—including the introduction of electronic tax stamps and centralized gold trading—corruption and weak enforcement hinder progress. A 2022 anzania Extractive Industries Transparency Initiative (TEITI) report cited on-going challenges in enforcing mining laws.

Tanzania has tried to formalize artisanal mining by establishing over 100 mineral trading centers, such as the Geita Mineral Trading Centre launched in 2017. These centers increased official gold exports by 27 percent in 2018. As of 2024, 128 centers are operational, although nearly a third are underutilized.

Still, only 5 percent of the estimated 1.5 million Tanzanians in artisanal mining operate legally. Price disparities, weak border controls, and bribery—reported by 27 percent of miners in a 2023 Transparency International survey—continue to fuel smuggling.

International scrutiny has intensified. In 2023, a Swiss refinery was fined for sourcing illicit Tanzanian gold, and Le Temps reported rising black-market prices in mining towns. Dubai remains a major destination for smuggled gold, reportedly importing $15 billion in undeclared African gold annually.

The economic damage extends beyond gold. The illicit trade in tanzanite and copper is also rising. Norwegian Church Aid estimated $300 million in smuggled tanzanite annually, much of it routed through Kenya or India.

Some reforms which were made by the late President John Magufuli included auditing mining companies and cracking down on tax evasion. In a landmark 2017 case, Acacia Gold Mining was slapped with a $190 billion bill for 17 years of alleged illegal operations.

Recent TMAA reports show increased seizures: in 2022, $15.2 million worth of minerals were intercepted, 84 percent of which was gold. In one case, 427 kilograms were found hidden in electronic equipment destined for Dubai.

While Tanzania has taken steps to combat illicit financial flows (IFFs), smuggling persists due to systemic governance weaknesses, poverty, and lucrative black markets. Safeguarding the nation’s mineral wealth will require stronger enforcement, transparency, regional cooperation, and more equitable access to formal trade channels for small-scale miners.

These cases underscore systemic challenges in the mining sector, including trade mis-invoicing, underreporting, and smuggling. Addressing IFFs will require strengthening customs surveillance, adopting technologies like block chain for mineral tracking, and enhancing international cooperation.

Another common strategy involves using complex corporate structures, shell companies, and tax havens to obscure ownership and profits, enabling both domestic and multinational firms to shift earnings to low-tax jurisdictions and deprive Tanzania of critical revenues.

The consequences of IFFs are profound, undermining both national development and the livelihoods of local communities.

Hassan Kulwa, Deputy Information Officer for the Federation of Miners’ Associations of Tanzania (FEMATA), remarked that IFFs are largely driven by the complexity of revenue collection systems.

Internationally, organizations like UNCTAD later cited Tanzania’s mineral markets as a model for reducing IFFs in artisanal mining. Francis Mihayo, Assistant Commissioner for Artisanal and Small-Scale Mining (ASM) in the Ministry of Minerals, acknowledged that IFFs remain a serious challenge, particularly through mineral smuggling and tax evasion.

Historically, lack of mineral markets near mining sites contributed to the problem, prompting the government to expand access in hopes of addressing the issue. Tackling IFFs is not only critical for the mining industry but also for the broader economic and social stability of Tanzania.

The Sealing the Gaps report of November 2020 estimated that Tanzania had lost millions of dollars through IFFs in its mining operations—particularly concerning given that gold accounts for 90 percent of the country’s mineral export value.

A 2023 study by the UN Office on Drugs and Crime (UNODC) estimated that 30 to 40 percent of Tanzanian gold continues to be trafficked illegally—echoing earlier findings by Global Financial Integrity on trade misinvoicing.

The African Union, in its 2022 report, called for harmonized mineral trade policies across the continent to combat cross-border smuggling. This call aligns with Tanzania’s ongoing efforts to address illicit financial flows (IFFs) in its mining sector, particularly in gold trade.

2023 survey by Transparency International Tanzania revealed that 27 percent of artisanal miners admitted to bribing officials to bypass checkpoints. Gold remains the most trafficked mineral, but the illicit trade in tanzanite and copper is also on the rise, according to alerts issued by the TMAA and the Bank of Tanzania’s mineral trade bulletins.

The Norwegian Church Aid report similarly flagged the illicit tanzanite trade, estimating that $300 million worth of gemstones are smuggled out of Tanzania annually, often routed through Kenya or India.

Recent cases illustrate the scale and tactics of IFFs in the sector. In 2024, authorities seized 15.78 kilograms of gold at the Dar es Salaam Port, valued at approximately 3.4bn/- ($1.4 million), hidden in a container falsely declared as other goods.

In 2023, 432 kilograms of gold worth 90bn/- ($38 million) were discovered concealed in machinery at Julius Nyerere International Airport en route to Dubai.

Another 2021 case involved 58 kilograms of gold, worth 12.5bn/- ($5.4 million), disguised as dried fish at the Dar es Salaam Port.

These cases underscore systemic challenges in the mining sector, including trade misinvoicing, underreporting, and smuggling. Addressing IFFs will require strengthening customs surveillance, adopting technologies like blockchain for mineral tracking, and enhancing international cooperation.

Another common strategy involves using complex corporate structures, shell companies, and tax havens to obscure ownership and profits, enabling both domestic and multinational firms to shift earnings to low-tax jurisdictions and deprive Tanzania of critical revenues.

Hassan Kulwa, Deputy Information Officer for the Federation of Miners’ Associations of Tanzania (FEMATA), remarked that IFFs are largely driven by the complexity of revenue collection systems.

Similarly, Francis Mihayo emphasized that while formal markets have reduced some illicit activities, mineral smuggling remains a persistent challenge, especially in regions lacking accessible, regulated trading centres.

Key insight by experts

According to Silas Olan’g, an advisor at the Natural Resource Governance Institute (NRGI), artisanal and small-scale miners (ASMs) are a significant conduit for gold smuggling out of the country due to weak oversight by the responsible authorities.

He explained that multinational mining companies also engage in under-declaration and transfer pricing through their subsidiaries abroad. These subsidiaries often overprice imported machinery or under-price exports, enabling companies to sell gold at lower declared values and consequently pay less tax.

“If the government puts strong control on these established gold market centers and entrusts them to officials with good integrity and faithfulness to their work,” Olan’g emphasized, “then illicit gold trade will be eliminated.”

The 2022 World Bank report warned that illegal mining distorts local economies by creating a “shadow market,” diverting labour and investment away from regulated sectors.

Supporting this, the Tanzania Minerals Audit Agency (TMAA) estimated in 2021 that 30 percent of the gold produced in the country is smuggled, depriving the economy of formal revenue streams.

Former Mineral Commissioner Dr Peter Kafumu pointed out that Tanzania’s significant losses from illicit gold trade stem from interconnected factors, especially a weak regulatory framework. He noted that mining laws and regulations are often not effectively enforced, creating an environment where illegal mining and smuggling thrive.

Way forward

Responding to these challenges, Minister of Minerals Anthony Mavunde when tabling his ministry’s 2025/2026 budget in the National Assembly in Dodoma outlined a comprehensive strategy to curb illegal gold trade.

Some of the government’s plans among others are to establish and strengthen designated trading centers across the country where miners will be required to sell gold exclusively to licensed dealers, he stated.

The ministry also aims to enhance the effectiveness of resident mining officers by increasing their resources, such as vehicles and other essential tools.

To crack down on smuggling networks, Mavunde said the ministry plans to bolster special mining task force units and strengthen mineral checkpoint desks at borders, airports, and ports.

Additional measures include issuing e-permits and expanding domestic gold markets to streamline legal trade channels. The ministry is also increasing the use of digital tracking systems, such as electronic mineral tags, drones, and satellite monitoring, to trace gold from mining sites to export points.

Mavunde emphasized the government’s commitment to formalizing artisanal miners by promoting licensing and registration, thereby bringing them into the formal economy.

He noted that the Geological Survey of Tanzania (GST) will play a key role in ensuring that mineral right holders provide accurate reports of their gold production.

Significant legal reforms have also been enacted. The government amended the mining law under Article 27F, sections 5 and 6.

Section 5 stipulates penalties for mineral right holders who submit false production reports, while Section 6 mandates that all gold samples intended for export be verified by the GST. The reforms introduce heavier fines and stricter jail terms for illegal dealers and corrupt officials who facilitate smuggling. Tanzania is engaging with global gold markets, including Dubai, India, and Switzerland, to ensure that Tanzanian gold is traceable and exported legally.

This work couldn’t possible without the support of Thomson Reuters Foundation through the Media Foundation for West Africa as part of its global work aiming to strengthen free, fair and informed societies.

Top Headlines

© 2025 IPPMEDIA.COM. ALL RIGHTS RESERVED