PPP contracts; ‘Transparency sets confidence with investors’

CONSULTANTS on economic issues have urged the government to improve transparency in public-private partnership (PPP) contracts, as secrecy risks undermining investor confidence in such undertakings.

Prof. Anna Tibaijuka, research and former UN agency administrator, aired the view that disputes that come up in the course of implementing PPPs often stem from opaque arrangements.

She made the remark at a forum on the role of PPPs in achieving Tanzania’s Vision 2050 held in Dar es Salaam yesterday, where speakers stressed that transparent, well-structured agreements are essential to attracting sustainable investment.

Investment must be built on honesty and transparency, she stated, underlining that if a contract is hidden—PPP or otherwise—it likely fails basic standards. “Such deals become liabilities,” she emphasized, affirming that attracting serious investors requires legal clarity, consistent policy and credible oversight.

Dr Jamal Msami, executive director for the city research outfit REPOA, said challenges in tax systems, regulatory barriers and public distrust of the private sector still hold back PPPs.

“You can't have transparency without access to data,” he said. “Yet getting information from public institutions remains a major obstacle.” While many Tanzanians hold academic qualifications, critical thinking skills remain limited, affecting their ability to scrutinize development projects, he said, stressing that “we have plenty of certificates but not enough understanding. That weakens civic engagement and public oversight.”

He pointed at the need to involve sector experts in PPP monitoring as lack of technical capacity leads to institutional breakdowns and erodes trust. Dr Kafigi Jeje of the Arusha Institute of Accountancy said that PPPs are underutilized at the local level “despite many councils generating substantial revenue.”

Most councils still rely on the central government for up to 75 percent of their development budgets, he said, asserting that strategic use of PPPs could revive stalled projects and ease the pressure on national resources. Local authorities need to reduce fiscal dependency and adopt PPPs as viable alternatives, he specified.

In a variation of that argument, Prof. Tibaijuka cautioned that excessive local taxation stifles small businesses, citing experience as Muleba MP, where it became clear that district councils create unnecessary barriers to market access.

“PPP frameworks must also address market infrastructure and trade to empower local entrepreneurs,” she urged. Dr Milazi Mursali, a Planning Commission official, said PPP initiatives must be aligned with national goals and directly benefit communities.

“As we look to 2050, we must prioritize inclusive, widely accepted projects,” he said. “And we must finish existing initiatives before launching new ones.” He appealed for greater autonomy for local governments to reduce delays caused by central-level bureaucracy.

David Kafulila, the PPP Center director general at the Treasury, said that achieving Vision 2050 will require a stronger role for private capital, as public financing alone is insufficient.

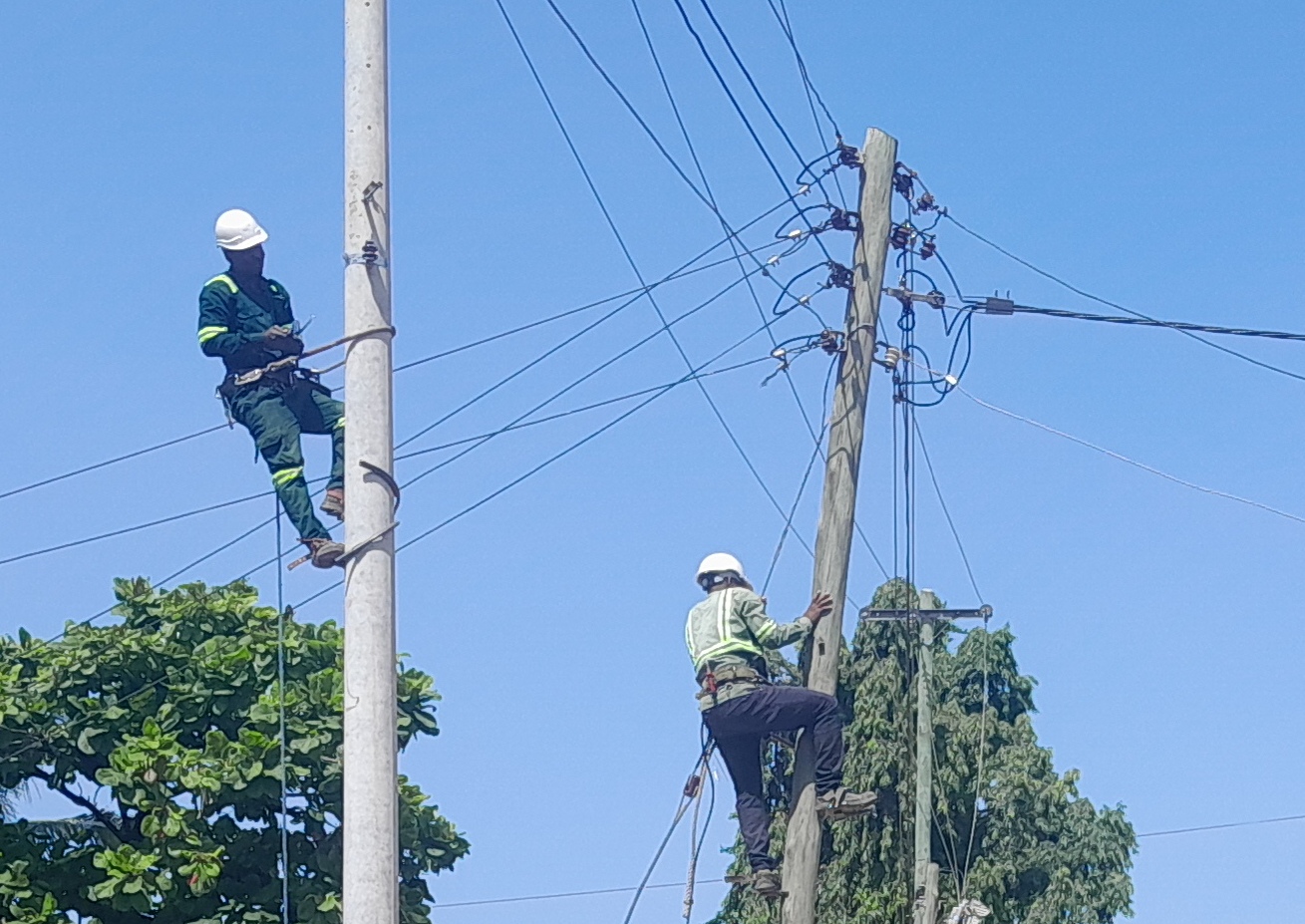

“PPPs give the government the leverage to invest in essential services like hospitals, schools and roads,” he said. “We cannot reach a $1trn economy through taxes and loans.” Expanding PPPs in energy, aviation and ports would free up government funds for sectors that directly impact citizens’ welfare, he added.

Top Headlines

© 2025 IPPMEDIA.COM. ALL RIGHTS RESERVED