Banking sector thrives on digital expansion with inclusive lending

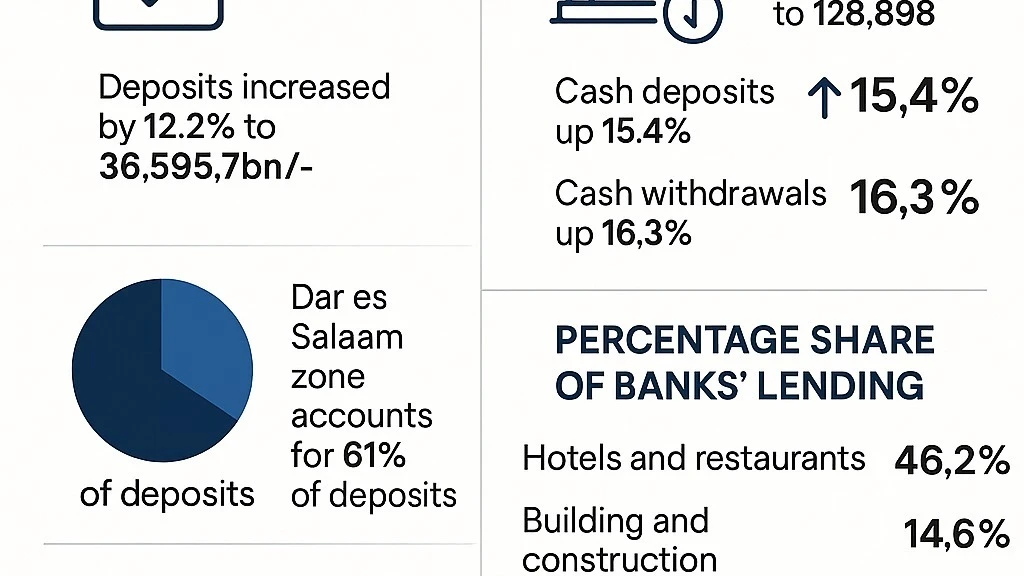

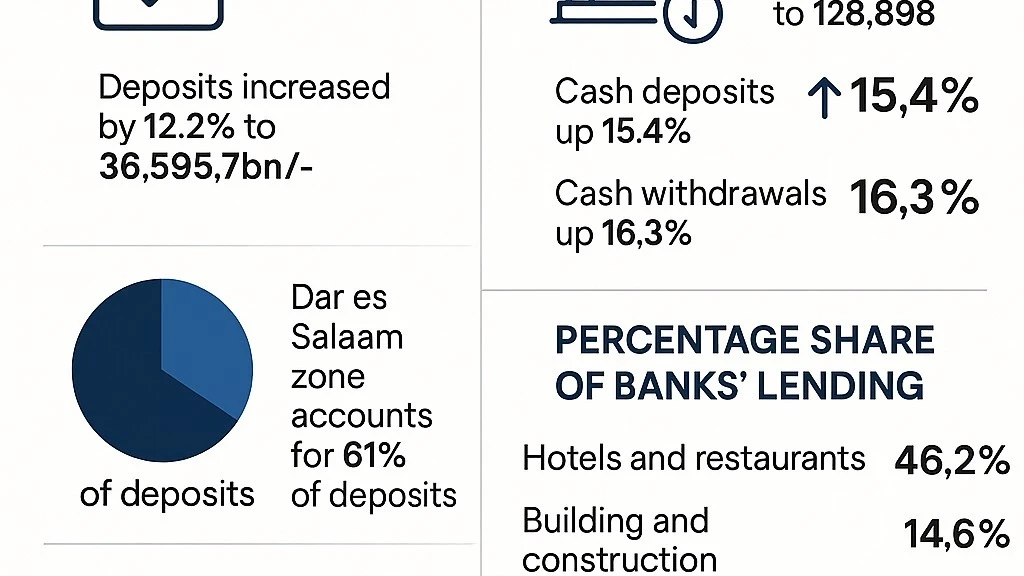

Deposits mobilized by banks across all zones recorded strong growth, increasing by 12.2 percent to 36,595.7bn/- compared to 35,558.5bn/- recorded in December 2023.

This improvement was largely attributed to enhanced agent banking services and the widespread use of mobile banking platforms, which have made financial services more accessible to the public.

According to consolidating zonal economic report for December 2024, the number of bank agents increased substantially by 26.8 percent, reaching 128,898 agents by the end of the review period from 101,673 recorded in December 2023.

“This rise is a result of collaborative efforts by the Bank of Tanzania (BoT) and other stakeholders aimed at promoting financial inclusion,” says the report.

As agent banking expanded, the volume of cash deposits and withdrawals made through these agents grew by 15.4 percent and 16.3 percent, respectively, compared to the same quarter in 2023.

Correspondingly, the value of cash deposits and withdrawals through agents also rose, by 7.4 percent and 27.3 percent, respectively. The increase in both volume and value of transactions is linked to the convenience and accessibility provided by the growing network of retail agents throughout the country.

In the South Eastern zone, high earnings from cashew nut sales significantly boosted deposit levels.

Meanwhile, the Dar es Salaam zone continued to dominate the banking sector, accounting for 61 percent of all deposits mobilized during the period under review.

Lending

Bank loans to various economic sectors experienced an annual growth of 14.5 percent, reaching 33,217.4bn/- by December 2024.

This performance reflects improved business conditions and deliberate measures by the Bank of Tanzania to foster financial inclusion. Notably, approximately 75 percent of all bank loans were directed to personal, agricultural, and trade-related activities.

Across all zones, the hotels and restaurants sector accounted for the largest average share of bank lending at 46.2 percent, followed by building and construction (14.6 percent) and personal loans (14.3 percent).

The average share for sectors such as services (6.2 percent), financial intermediation (5.3 percent), and mining and quarrying (3.3 percent) shows that while a few sectors dominate, there is a noticeable effort toward credit diversification in some regions.

In the Central zone, banks heavily invested in the hotels and restaurants sector, which accounted for 38.2 percent of total loans. Personal lending was the second-largest category at 29.3 percent, reflecting a strong demand for individual credit.

The financial intermediation sector followed with 18.2 percent, indicating active participation by financial institutions in extending credit facilities. Other notable sectors included building and construction (5.4 percent) and services such as health and education (3.6 percent), though they were relatively smaller compared to the dominant sectors.

The Dar es Salaam zone showed a more diversified credit portfolio. While building and construction took the lead with 15.4 percent, the services sector (mainly health and education) and real estate were also significant, accounting for 15.3 percent and 5.7 percent, respectively.

Financial intermediation made up 6.4 percent, while wholesale and retail trade, personal loans, and manufacturing each held between 4–6 percent. This reflects Dar es Salaam’s role as a commercial and financial hub with a variety of lending needs across sectors.

In the Lake zone, the hotels and restaurants sector dominated lending activity, absorbing 48.4 percent of the total credit.

This was followed by building and construction (15.2 percent) and personal loans (16.5 percent), indicating robust demand for both infrastructure and consumer financing.

Credit to services (6.4 percent) and mining and quarrying (4.2 percent) also featured, consistent with the region's tourism and mineral resource activities.

Banks in the Northern zone allocated nearly half of their credit (49.5 percent) to the hotels and restaurants sector, the highest among all zones.

This is pointing to the region’s focus on tourism and hospitality. Building and construction followed with 12.1 percent, and personal loans accounted for 11.1 percent. Lending to services (9.5 percent) and mining and quarrying (8.9 percent) also reflects the zone’s diverse economic activities.

In the South Eastern zone, hotels and restaurants made up an overwhelming 77.3 percent of total loans—the highest share across all zones—likely due to tourism and hospitality-driven economic activities.

However, other sectors received minimal credit, with building and construction at 7.3 percent and personal loans at 8.3 percent. Sectors such as agriculture, manufacturing, and education remained marginal, indicating a highly concentrated credit distribution.

The Southern Highlands zone showed a different lending pattern, with building and construction being the dominant sector at 32.0 percent, suggesting significant infrastructure development in the region.

Hotels and restaurants followed at 40.3 percent, and personal loans contributed 15.2 percent. The presence of credit in manufacturing, services, and others was modest, pointing to a relatively narrow but developing credit base.

Top Headlines

© 2025 IPPMEDIA.COM. ALL RIGHTS RESERVED