How digital payments fuel revenue growth

A paradigm shift is taking place in the retail sector. Driven by innovation and a changing demographic with a more digital-first appetite, we have seen innovations that have been instrumental in increasing sales, improving customer interaction, enhancing convenience, and reshaping the entire customer journey for shoppers.

From loyalty programmes to AI-powered product recommendations, retailers are leveraging technology not just to meet consumer expectations, but to anticipate them. Digital payments have been at the heart of this innovation, with retailers integrating mobile wallets, cards, multi-currency options, and conveniences like one-click checkouts to reduce purchase abandonment.

These shifts have led to what is being referred to as the modern retail sector. Its contribution to economic growth through job creation, encouraging entrepreneurship, and attracting investment is fuelling local economies and supporting national development goals.

According to Statista, e-commerce in Africa was valued at $16.5 billion in 2017. Another report by the McKinsey Consulting firm, states that this value could well go up to $75 billion by end of 2025. This dramatic rise indicates a huge chance for companies and investors to participate in the continent’s developing digital economy, which is being fuelled by growing internet usage, mobile adoption and a vibrant youth populace.

An example of this is in Kenya where Statista reports an accounted estimate of $1.1 billion in e-commerce revenue in 2020, making it the country with the highest digital revenue generation. The adoption of the digital economy blueprint, which focuses on the ICT industry and e-commerce activities, has fuelled the expansion of e-commerce.

Furthermore, the proportion of Kenyans over 15 who have bank accounts (50.6 percent), or mobile money (68.7 percent) has been rising over time. Notably, Kenya's internet user base has tripled in the last 10 years, from 7.48 million in 2014 to 22.7 million in January 2024. Because mobile money systems are so widely used, this increased connectivity has made it easier to conduct more transactions online.

Frictionless Payments: More Sales, Fewer Cart Abandonments

Friction at the conversion checkout point is a deterrent to sales in contemporary retail. Obstacles like a lengthy checkout process, limited payment options, or processing problems lead to high rates of cart abandonment both online and in-store.

Despite this, retailers embracing contactless payments, mobile wallets and one-click checkouts are removing this friction, with immediate results already being witnessed. Faster checkouts lead to better customer experience, higher conversion and larger basket sizes.

Options like Buy Now, Pay Later (BNPL) are also significantly changing the game. They help to enhance affordability and encourage higher-value purchases by enabling customers to spread payments over time, all without raising the retailer's credit risk. Simultaneously, subscription and recurring payment models are becoming more and more popular because they produce consistent, predictable revenue and encourage long-term client retention.

Multiple payment innovation is also helping retailers break down existing barriers to access. By accepting multiple currencies, mobile money platforms and global digital wallets such as Apple Pay, Google Pay, iPay and Union Pay, businesses can tap into cross-border commerce and segments of underserved consumers.

In Africa, particularly East Africa, mobile money continues to be a game changer, as it enables millions of consumers to participate in the booming digital economy. Additionally, with the rise of embedded payments and social commerce, retailers are now reaching customers directly in the platforms they use the most, whether that is TikTok, Instagram, WhatsApp, Facebook or X. The result? More customers, more touchpoints and ultimately more sales.

Further, retailers who invest in technology-led payment solutions are getting an added advantage of accessing up-to-date information and insights on customer preferences, spending patterns, and buying trends, which can be used for targeted offers, personalised marketing, and even successful loyalty programs that foster closer ties with customers.

The Role of AI & Emerging Technologies in Shaping Retail

In the unfolding future, cutting-edge technologies like blockchain and artificial intelligence (AI) are revolutionising the digital payments market. AI is already significantly improving payments through its ability to automate compliance checks, enhancing fraud detection, streamlining repetitive payments and allowing for customers to have a personalized experience. I.e. Through machine learning payments are intelligently routed to dynamically choose the optimal transaction paths, enhancing acceptance rates while cutting down on processing expenses.

On the other hand, blockchain presents the possibility of more effective, safe and transparent payment methods. Beyond the common association with crypto currencies, blockchain technology can minimize transaction feed, speed up cross-border transactions while also shortening settlement times. Another example of how blockchain frameworks can change economies is via Central Bank Digital Currencies which are increasingly gaining popularity worldwide.

For retailers, adopting these technologies would not be just about chasing trends but would speak towards creating resilience and opening new growth prospects. As more digital ecosystems mature, retailers who decentralise their financial models by leveraging these new technologies will be better equipped to meet customer expectations, safeguard transactions and gain an edge by expanding their market reach.

Turning Payments into a Platform for Growth

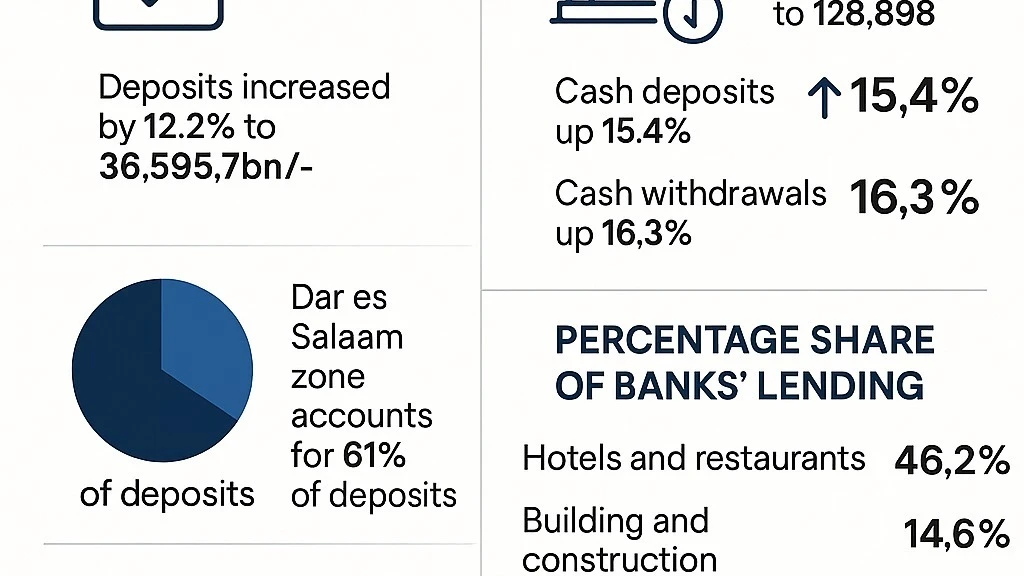

At Network, we have witnessed how modern payment solutions can unlock real growth for businesses while supporting over 130,000 active merchants and 250 banks, fintechs and telcos across more than 50 countries

Our suite of innovative solutions, from e-commerce, Tokenization, Buy Now Pay Later (BNPL) and tap-on-phone technology to advanced fraud prevention, anti-money laundering (AML) tools, loyalty programmes, and rich data analytics, is transforming the way retailers operate. These tools not only simplify how consumers pay but also enhance how businesses manage operations, engage customers, and make data-driven decisions.

By offering a unified platform for payment acceptance, we eliminate the hassle of juggling multiple systems, giving merchants a seamless, secure, and scalable solution that allows them to focus on what matters most: growing their businesses.

What’s clear from our experience is that forward-thinking retailers no longer treat payments as a cost centre, but rather see it as a strategic advantage. Ranging from enhancing the checkout experience to expanding into new markets, payments have become an enabler of business transformation.

It is therefore clear that businesses that are set to thrive in this new environment are the ones that embrace innovation in not just what they sell, but also how they let their customers make payments.

Payment innovation is reshaping the future of retail in Africa and beyond. It is driving conversions, building loyalty, expanding reach and creating a foundation for sustainable revenue and scalable growth. The question for retailers is no longer whether they should innovate their payment strategies, but instead how quickly they can do so.

Top Headlines

© 2025 IPPMEDIA.COM. ALL RIGHTS RESERVED