Collective investment schemes combined assets value hits 2.3trn/-

The combined assets value of all Collective Investment Schemes (CIS) operating in Tanzania has reached 2.3 trillion/-, positioning it as a crucial resources for stimulating the country’s financial markets and encouraging broader participation among Tanzanians in investing in capital and money markets.

Tanzania currently has eight registered collective investment schemes, with the majority managed by the Unit Trust of Tanzania (UTT-Amis), the largest fund manager in the country. Retail investors account for the largest share of these schemes by number.

Most schemes began with a minimum investment of just 10,000/-, enabling Tanzanians from various financial backgrounds to participate.

Raphael Masumbuko, CEO of Zan Securities—a prominent investment advisory firm and member of the Dar es Salaam Stock Exchange (DSE)—acknowledges that while the combined fund size is still relatively small, there is significant potential for future growth.

“The positive aspect is that Tanzanians are increasingly looking to diversify their investments. Many now recognize the importance of not putting all their investments into a single basket,” said Masumbuko. His firm recently launched the Timiza Fund, a new CIS, which raised 10.38 billion/- during its initial offering—an oversubscription of 103 percent compared to the targeted 10 billion/-.

Masumbuko noted that more people are considering diversified investments as a means of mitigating risks.

He emphasized that the growth of collective investment funds demonstrates that individual investment is not the only path to financial returns—those investing collectively can also expect substantial gains.

National Social Security Fund (NSSF) Investment Officer, David Mtenda, praised the Timiza Fund for its attractive returns and strong governance.

"We invested in Timiza because of its 13 per cent annual return, which is significantly higher than the 8 per cent to 12 per cent offered by other funds," he said.

George Mapunjo, a teacher at Jangwani Secondary School, shared that his decision to invest was influenced by the fund's affordable unit prices and diversified investment strategy.

"The reasonable unit prices and the fund's name, "Timiza' (meaning "fulfill'), inspired me to invest as I strive to achieve my financial goals," said Mapunjo.

Speaking during the announcement of the sale results for Timiza Fund, Alfred Mkombo, the director of Research and markets development, CMSA said activities on the capital markets are conducted in accordance with the laws, regulations and guidelines to ensure openness and rights to all players.

“CMSA would like to assure the public that the capital markets are safe and sustainable and this is the result of increased public education by the authority and other stakeholders as well as an enabling environment for investments,” he said.

He said CMSA has lowered the amount of minimum investments to 10,000/- from 1m/-, which has attracted many people to invest in capital markets.

Belinda Richard, a 45-year-old mother of two, has invested in the Umoja Fund since its inception nearly two decades ago.

“With the massive campaign held during its launch, I did know what collective investment is all about, that is why I decided to try investing with no option of exiting,” she said.

She initially invested 70,000/-, which was converted into 1,000 units. At that time, the government offered an incentive of 30/- per unit, increasing her investment to 100,000/-. "Since then, I’ve never sold my units, and my investment has grown to nearly 1.2 million/-," she told The Guardian.

Reports indicate that collective investment schemes offer annual returns ranging from 8 percent to 13 percent, with minimal risk, as funds are currently invested in equities, bonds, and other profitable financial products.

Another retail investor, who invested 1 million/- in the Watoto Fund managed by UTT-Amis 16 years ago, reported that her investment has grown to 6.7 million/-.

She believes the units will be a valuable financial asset for her 20-year-old son, who is currently studying at a technical college.

"This trend reflects market growth, especially considering that the combined fund size was less than 500 billion/- just four years ago," said Imani Muhingo, Head of Research and Market Analytics at Alpha Capital Limited, a brokerage and investment advisory firm. “However, there is still substantial room for growth. For example, neighboring Kenya has nearly 4 trillion/- in Assets Under Management (AUM).”

Charles Shirima, Public Relations Manager at the Capital Markets and Securities Authority (CMSA), noted that there is a positive outlook due to increased financial and investment awareness, leading to more investors participating in CIS.

"This growth is a result of our ongoing public education campaigns, conducted in collaboration with fund managers," he said.

"We are now seeing more private funds entering the market compared to earlier times when only government-owned funds under UTT-Amis and the Faida Fund, managed by Watumishi Housing Investment (WHI), were available."

Shirima also highlighted the conducive legal and regulatory environment that has encouraged the growth of these funds, offering Tanzanians more opportunities to invest collectively.

Looking ahead, Shirima mentioned that CMSA recently approved the Alpha Halal Fund, which will focus on Shariah-compliant financial products for those preferring not to invest in conventional financial products.

He also revealed that CMSA has received three additional inquiries for the establishment of new funds under management.

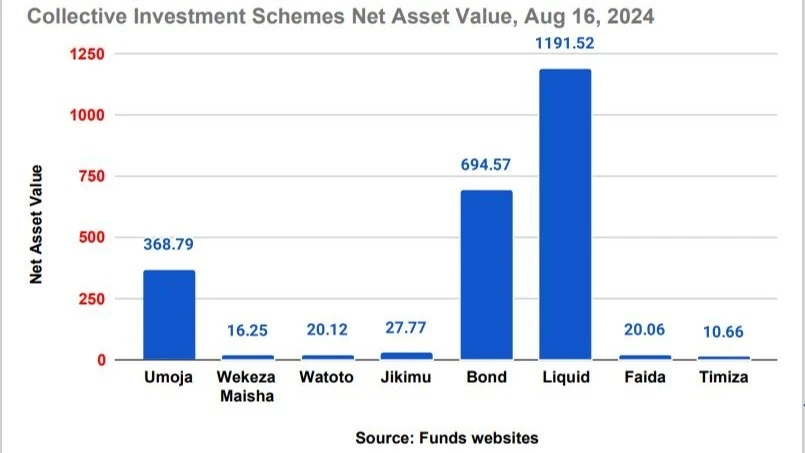

As of August 16, 2024, the largest CIS by size is the Liquid Fund, managed by UTT-Amis, with 1.1 trillion/-, followed by the Bond Fund at 694.6 billion/-, and Umoja Fund at 368.79 billion/-.

Other collective investment schemes include the Wekeza Maisha and Watoto Funds managed by UTT-Amis, the Faida Fund managed by WHI, and the Timiza Fund managed by Zan Securities Limited.

Top Headlines

© 2025 IPPMEDIA.COM. ALL RIGHTS RESERVED