DSE investor numbers soar to 670,000 by May 2025

The Dar es Salaam Stock Exchange (DSE) has seen a remarkable surge in investor registrations, reaching 670,000 by the end of May 2025, a significant leap from just 35,000 recorded at the close of last year.

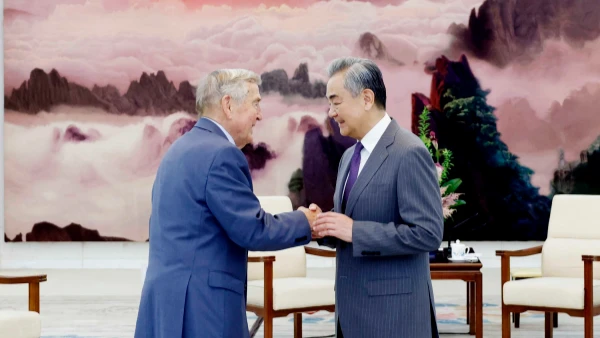

This impressive growth is largely attributed to the enhanced digitalisation investments made in 2024. DSE Chief Executive Officer, Peter Nalitolela (pictured), revealed these figures on Wednesday during the 10th annual general meeting held at the bourse's premises in Dar es Salaam.

Nalitolela highlighted that the DSE has experienced "substantial growth of profit, increased capital and growth of transactions driven by the growth of investors through our digital trading app."

The bond market has also seen expansion, with non-government bonds increasing to five by the end of the first half of 2025, up from just one. More are anticipated in the latter half of the year.

The DSE has actively engaged in policy lobbying, and Nalitolela expressed satisfaction with the Sixth Phase Government under President Dr. Samia Suluhu Hassan. He noted that the government has implemented positive investment policies to promote capital and securities markets. President Hassan has encouraged government institutions to enter the stock exchange to secure capital.

Furthermore, large commercial companies majority-owned by the government and managed through the Treasury Registrar have been urged to list their shares. Non-commercial entities needing capital for development projects are also encouraged to raise funds through bonds, citing the example of the Tanga Water and Sewerage Authority.

Currently, DSE's core business relies on listing fees for both equities and securities, along with annual fees. However, a significant portion of income is generated when new products are introduced to the market.

Additional revenue streams for DSE include fees from trading transactions, sale of data to investors and investment advisors, and fees from training various stakeholders through the DSE Academy.

Nalitolela assured existing and prospective investors that the DSE "will continue to grow our sources of income by expanding revenue streams through an increase of market products, more than traditionally shares and securities." He also hinted at "more products that we are expecting in the near future."

Mary Mniwasa, the DSE Company Secretary, announced that dividends for investors are expected to be paid soon, though an exact date was not provided. She urged shareholders to update their payment details through the register, as some have yet to submit their information.

As of the end of May 2025, the DSE had 2,902 shareholders with a total of 23.8 million paid-up shares. In 2024, the DSE and its subsidiary recorded a profit of 4.27bn/-, which was 24 percent lower than the 5.69bn/- reported in 2023.

During its May board meeting, the directors approved a proposed dividend of 70 percent of the net profit recorded in 2024, amounting to 2.99 billion/- or 125.50/- per share. This is compared to 3.45 billion/- or 145/- per share paid in 2023. Shareholders approved the proposed dividend at the meeting.

DSE board chairman Daniel ole Sumayan stated that Tanzanians are beginning to understand the importance of investing in various listed companies. He encouraged Tanzanians to continue utilizing the market for wealth creation and to improve market efficiency.

Sumayan also pledged that the DSE would provide market information to help investors make informed decisions and promised to address all inquiries and advice raised by investors during the meeting. He emphasized that "the doors are open for engagement with shareholders, in case you require any clarifications and we should not wait until another annual general meeting, which is held only once per year."

Shareholder Charles Mswemwa advised the self-listed DSE to quantify the company’s management account for the coming financial year to allow for a clearer comparison of achievements during the next AGM.

Top Headlines

© 2025 IPPMEDIA.COM. ALL RIGHTS RESERVED