Mbeya, Songwe Regions become Tanzania’s gateway to SADC market

Across the world, high costs of import and export logistics remain a major barrier to trade, economic growth, and the movement of goods and people.

Studies show that in Southern Africa, such costs have slowed both international and regional trade, undermined industrial competitiveness, and worsened shortages of essential goods especially food.

Among the leading causes are port delays and border inefficiencies, which inflate transport costs and lead to significant time losses. Tanzania’s main Africa trading blocs include the East African Community (EAC) and the Southern African Development Community (SADC).

Trade between Tanzania and the EAC has remained stable but relatively modest in recent years. Between 2021 and 2024, Tanzania’s exports to EAC countries increased only slightly from USD 1.161 billion to USD 1.164 billion, a marginal growth of just 0.2 percent. In fact, exports dipped sharply by over 16 percent in 2023, from USD 1.02 billion in 2022 to USD 0.9 billion, largely due to various challenges.

Imports from the EAC also declined, falling from USD 0.44 Billion in 2022 to USD 0.4 Billion in 2023, before stabilizing at around USD 527 million in 2024. Overall, Tanzania has maintained a trade surplus with the EAC, but the margin has narrowed from USD 880 million in 2021 to USD 755 million in 2022.

By contrast, trade with SADC has grown at a much faster pace. Tanzania’s exports to SADC countries more than doubled in just three years, rising from USD 1.303 billion in 2021 to USD 2.968 billion in 2024, an increase of over 127 percent. In 2024 alone, exports surged by more than 70 percent.

Meanwhile, imports from SADC countries remained stable at around USD 786 million. South Africa remains the dominant source, accounting for more than 3.6 percent of Tanzania’s total imports. Compared to the EAC, Tanzania enjoys a far larger trade surplus with SADC. In 2020, the surplus with SADC was USD 1.09 billion double that recorded with the EAC.

This dual picture highlights the challenge for Tanzania: while SADC offers greater growth and momentum, sustainability depends on diversifying exports beyond a single, volatile commodity.

The Port of Dar es Salaam has positioned itself as a key gateway for regional trade. More than 57 percent of all cargo handled is destined for Tanzania, with the Central Corridor contributing 30 percent, and the remainder flowing through other routes.

For exports, 54 percent originates from Tanzania, 28 percent from Central Corridor countries, and the rest from outside the corridor. Between 2021 and 2025, reforms and infrastructure upgrades transformed the port into a more efficient hub. Cargo volumes rose from 17.05 million tonnes in 2021 to 27.76 million tonnes in 2025.

Ship waiting time fell dramatically from 46 days in 2021 to just 7 days in 2025, while container handling capacity increased from 17,000 to 25,000.

SADC countries such as Zambia, the Democratic Republic of Congo (DRC), Malawi, and Zimbabwe depend heavily on this port. Though Durban in South Africa, Lobito in Angola, and Beira in Mozambique remain alternatives, Dar es Salaam holds an advantage in distance and efficiency. With the Standard Gauge Railway (SGR) nearing completion, its integration with the port promises even smoother cargo movement via Kwala dry port.

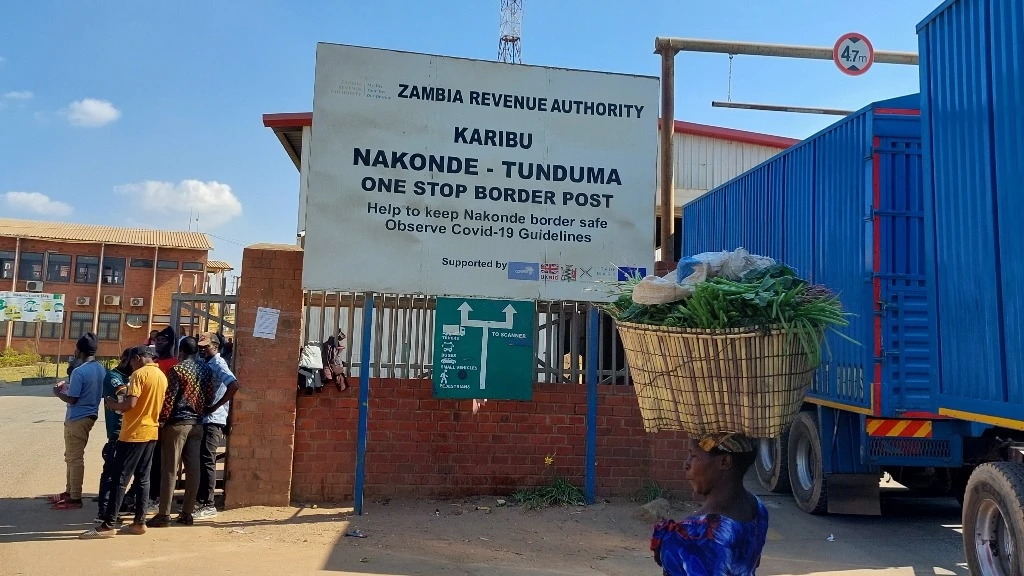

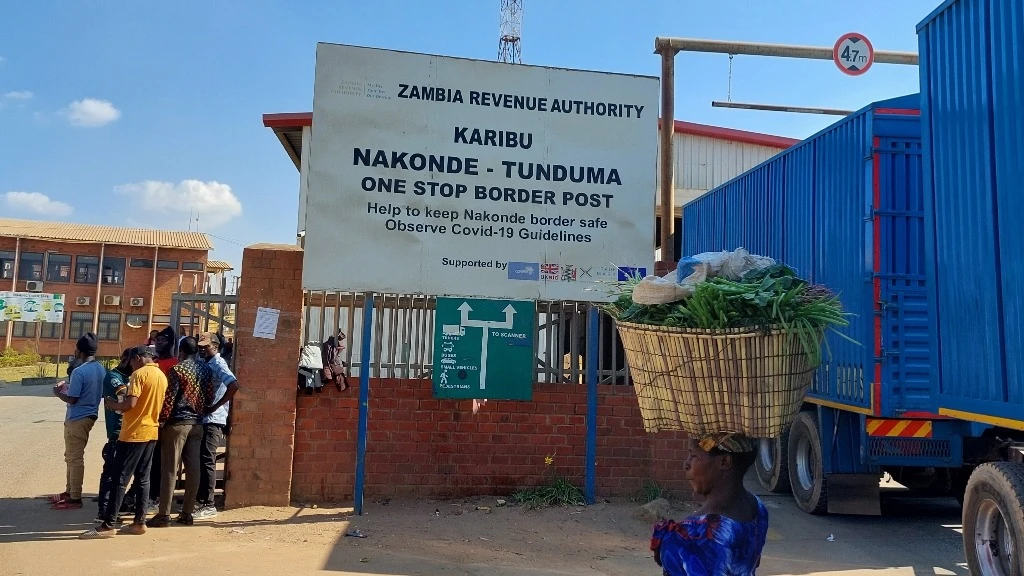

Over 70 percent of international cargo through Dar es Salaam follows three main corridors: Dar es Salaam–Mbeya–Kasumulu–Lilongwe–Blantyre; Dar es Salaam–Mbeya–Tunduma/Nakonde OSBP–Kapiri Mposhi–Lusaka; and Dar es Salaam–Mbeya–Tunduma/Nakonde OSBP–Kasama–Mansa–Kasumbalesa–Lubumbashi.

These routes underscore Tanzania’s role as a regional trade hub. Mbeya and Songwe regions, with their key border posts at Tunduma and Kasumulu, connect Tanzania to markets in Zambia, Malawi, the DRC, and Zimbabwe together home to over 168 million people. The historic TAZARA railway, the TANZAM highway, and Songwe International Airport further highlight their strategic importance.

According to TradeMark Africa, Tunduma is the busiest border post in East Africa, handling the bulk of cargo from Dar es Salaam to neighboring countries. While Namanga on the Kenya–Tanzania border is lauded for efficiency through its One-Stop Border Post (OSBP) model, and Busia and Malaba on the Kenya–Uganda border are known for cross-border flows, Tunduma leads in sheer cargo volume, anchoring Tanzania’s SADC trade.

The government of Tanzania has prioritized opening up Songwe and Mbeya by investing in key infrastructure between 2021 and 2025. Expansion of the Igawa–Tunduma (218 km) and Nsalaga–Ifisi (29 km) roads, together with new bypasses, is expected to ease congestion.

The installation of X-ray scanners at Tunduma has cut cargo clearance time by 40 percent, while digital systems have reduced truck crossing time from four days to one. Integration of customs and immigration services has shortened clearance times from four days to one, lowering transport costs. As a result of these efforts, cargo volumes rose from 3 million tonnes in 2021 to 9 million tonnes in 2024.

In addition to ongoing projects, political commitments have reinforced the strategic role of these regions. During campaigns, the presidential candidate from the ruling party CCM pledged to complete the construction of a modern dry port at Songwe, just 13 km from Tunduma, on a 1,800-acre site.

This facility is expected to decongest Tunduma by providing modern services including adequate parking, warehouses, scanners, weighing facilities, banking services, areas for small-scale traders, and community amenities.

The pledges also included installation of more scanners and smart gates to reduce truck delays to under 24 hours, modernization of the 1,860 km TAZARA railway through a USD 1.4 billion public–private partnership with CCECC, and expansion of Songwe’s paved road network from 306 km to over 500 km by 2030.

Alongside road and rail improvements, the Rumakali Hydropower Project promises to provide Mbeya with reliable electricity. This 222 MW project involves construction of a hydroelectric plant in Makete, Njombe, and a 64.5 km transmission line linking the plant to the Iganjo substation in Mbeya. With this stable power supply, industrial processing and manufacturing in Mbeya and surrounding areas will gain momentum, enabling the region to better serve SADC markets.

Consequently, completion of these infrastructure projects offers wide-ranging opportunities for the people of Mbeya and Songwe. The two regions are already Tanzania’s breadbasket, producing cereals, fruits, and other food to feed regional markets. Their location also makes them major transit points for goods from across the country.

Tanzania exports an average of USD 154.2 million worth of goods annually to the DRC, including cereals, flour, salt, Sulphur, cement, tobacco and its products, beverages, spirits, steel and roofing sheets, fertilizers, glass, soap, lubricants, artificial flowers, textiles, timber, charcoal, and plastics, while importing only USD 2.592 million worth of goods.

Trade between the DRC and Tanzania grew by 180 percent between 2021 and 2025, highlighting the immense potential of this corridor.

The TAZARA railway modernization will bring major economic benefits not only to Mbeya and Songwe but also to the country as a whole. Rail transport cuts long-distance cargo costs by an average of 68 percent (every three shillings by road equals one shilling by rail). It reduces travel time by over 50 percent compared to road haulage, making it possible for farmers and traders in Mbeya and Songwe to access markets quickly and affordably.

At the national level, it will reduce road maintenance costs, cut fuel import bills, and save up to 75 percent of carbon emissions. As economist Dr. Bravious Kahyoza has noted, transport costs account for between 35 and 60 percent of production costs, meaning a reliable railway system will be a game-changer for competitiveness and market access.

The completion of the new passenger terminal at Songwe International Airport also opens vast opportunities for private investment. These include partnerships with the Tanzania Airports Authority (TAA) to develop modern cold-storage facilities for perishable exports such as fruits and flowers, and investments in gold, coal, and strategic minerals found in Mbeya and Songwe.

The airport also provides a platform for developing modern hotels and conference facilities to host major meetings, including SADC summits, given the regions’ proximity to several SADC countries. Coupled with natural attractions such as Lake Ngozi, Mount Rungwe, and Kitulo National Park, Mbeya and Songwe also offer strong prospects for tourism development.

Despite these achievements, challenges remain that require coordinated efforts between government and the private sector. The regions still need modern truck parking yards in districts various councils such as Tunduma, Kasumulu, Rungwe, and Kyela, ideally developed through Public Private Partnerships.

At Tunduma OSBP, financial institutions must provide 24-hour services, while on the Zambian side at Nakonde, there is need for modern scanners, parking, and extended working hours.

Systems of the Tanzania Revenue Authority (TRA) and TANROADS could be better integrated to reduce inspection times, while the number of weighbridges between Dar es Salaam and Tunduma/Kasumulu should be reduced from the current six (Vigwaza, Mikese, Mikumi, Wenda, Makambako, and Mpemba/Uyole).

By comparison, the Mombasa–Busia route has five weighbridges (Mariakani, Mlolongo, Gilgil, Dongo Kundu, and Busia), and Kenya is considering consolidating them into a single Mariakani weighbridge. Addressing these bottlenecks would significantly reduce delays and transport costs.

These developments reflect the government’s commitment to transform Tanzania’s Southern Highlands into a hub of regional trade and growth.

Mbeya and Songwe now stand at the forefront of linking Tanzania to the vast SADC market driving jobs, boosting national revenue, and improving livelihoods.

With the right policies and private sector engagement, the two regions can become not only Tanzania’s economic engines but also pivotal anchors of Africa’s regional integration.

Top Headlines

© 2025 IPPMEDIA.COM. ALL RIGHTS RESERVED