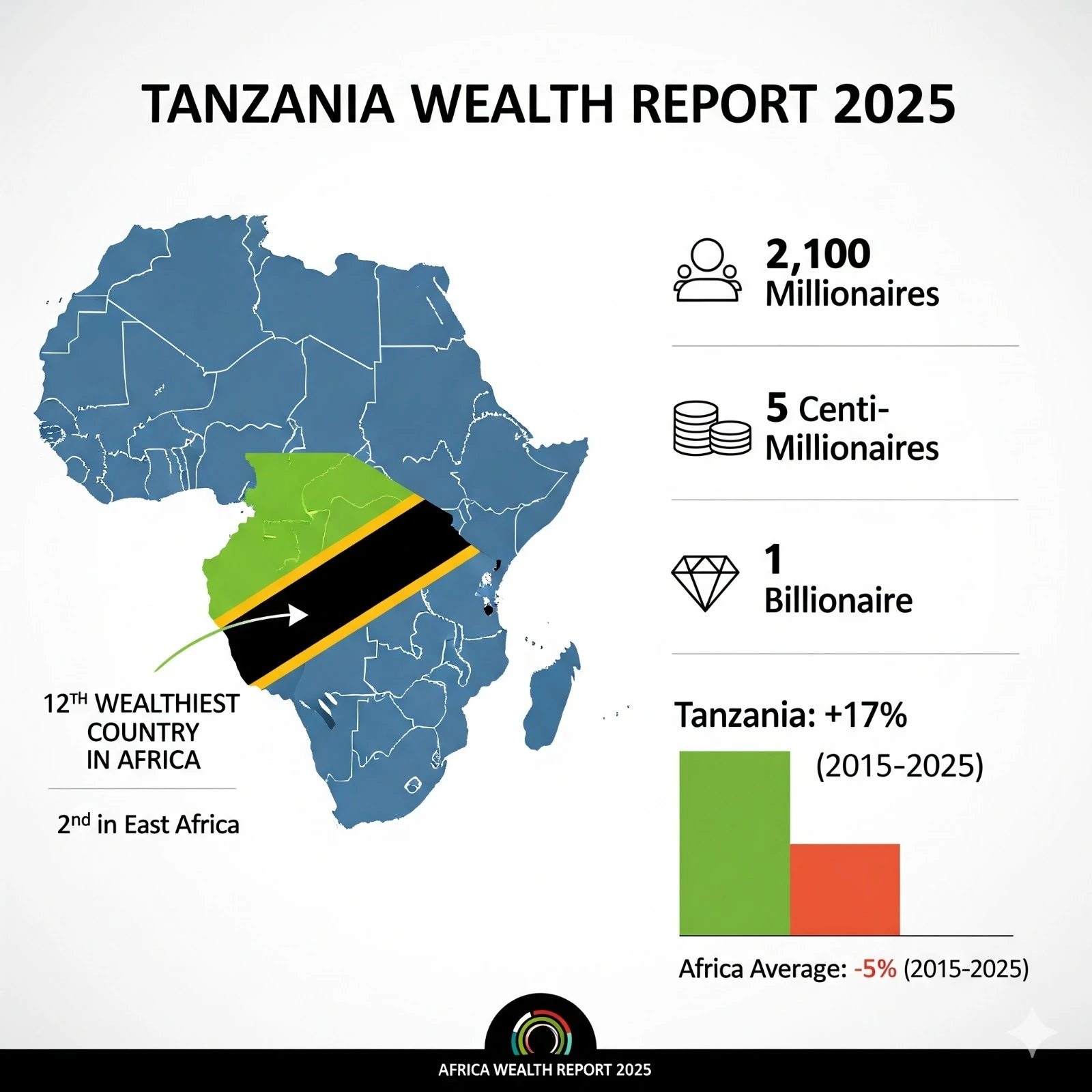

Tanzania ranks 12th wealthiest country in Africa

Tanzania has been ranked the 12th wealthiest country in Africa and the second in East Africa, making it one of the most suitable nations for growing personal wealth.

This is according to the new Africa Wealth Report 2025, published last week by Henley & Partners, a global leader in residence and citizenship by investment.

The report reveals that Tanzania is now home to 2,100 millionaires with a net worth of more than US$1 million (nearly 2.6bn/-).

The country also has five "centi−millionaires" with overUS100 million (nearly 260bn/-), and one billionaire with a net worth of more than US$1 billion.

The country has seen a 17 percent growth in its number of millionaires from 2015 to 2025, which is notably higher than the continental average growth of negative 5 percent during the same period.

The report's key indicators include household incomes, stock market capitalization, tax, and prime property statistics, rather than a country’s Gross Domestic Product (GDP).

Within the East African Community (EAC), Kenya leads with 6,800 millionaires and 16 centi-millionaires, although the region's largest economy has no billionaires. Kenya recorded a 14 percent growth in millionaires between 2015 and 2025.

Uganda ranks third in the region with 1,600 millionaires and five centi-millionaires, followed by Rwanda with 1,000 millionaires and three centi-millionaires. Both Uganda and Rwanda have no billionaires.

According to the report, Africa as a whole has 122,500 millionaires, 348 centi-millionaires, and 25 billionaires. South Africa leads the continent with 41,100 millionaires, 112 centi-millionaires, and 8 billionaires.

Dominic Volek, Group Head of Private Clients at Henley & Partners, stated that Africa’s sustained economic expansion, combined with significant growth in its high-net-worth-individual (HNWI) populations, positions the continent as a key player in the evolving global wealth landscape. “The investment migration sector is now working both ways, with African investors seeking greater global mobility and diversification while international investors are increasingly identifying Africa as a destination for long-term, stable capital deployment,” says Volek.

Other African countries with a large number of HNWIs include Egypt, Morocco, Nigeria, Kenya, Mauritius, Algeria, Ghana, Namibia, Ethiopia, Angola, Côte d’Ivoire, Botswana, Zambia, Mozambique, and Seychelles.

The report projects that Africa's millionaire population will grow by 65 percent over the next decade. “Private wealth markets across Africa are expanding strongly despite global headwinds, underpinned by robust economic growth,” the report says.

At the city level, Johannesburg holds the top spot as Africa’s wealthiest city with 11,700 resident millionaires, anchored by the Sandton business district and the luxury residential enclaves in the Waterfall–Midrand area.

However, Cape Town, placed second with 8,500 HNWIs, has emerged as the continent’s leader in centi-millionaires, with 35 super-wealthy individuals calling it home.

The "Mother City" is also Africa’s most expensive prime real estate market at US$5,800 per square meter and is on track to overtake Johannesburg in total wealth by 2030.

Cairo ranks third with 6,800 HNWIs and has the highest concentration of billionaires in Africa, with five residents. East Africa’s economic powerhouse, Nairobi, is in fourth place with 4,200 millionaires, accounting for almost half of Kenya’s total private wealth.

Commenting on the report, best-selling author and political analyst Justice Malala says, “Africa’s story remains one of dualities. Its economic trajectory reveals resilience and promise, bolstered by institutional innovation and growing investor confidence. Yet these exist alongside deep political fractures and governance setbacks. If African leadership can harness the momentum of economic growth while tackling political dysfunction with equal resolve, the continent may yet turn this moment of paradox into one of transformation.”

Andrew Amoils, Head of Research at New World Wealth, predicts that the increase in Africa’s millionaire population will likely be led by lifestyle destinations such as the Whale Coast, Cape Winelands, and Marrakech.

“The main industries expected to drive this growth include fintech, eco-tourism, software development, green tech, e-commerce, rare metals mining, healthcare, biotech, media, entertainment, and wealth management. With the EU and UK becoming less attractive among the global jet-set, there is potential for Africa to emerge as a major destination for wealthy entrepreneurs. There are already signs of this happening, with Morocco, Mauritius, Namibia, and Seychelles all projected to see big wealth inflows this year,” he said.

Jean Paul Fabri, Chief Economist at Henley & Partners, concludes, “The rise in Africa’s millionaire class is both a signal and a test. It signals that despite challenges, wealth is being created and retained in key markets. But it also tests the continent’s ability to turn private wealth growth into broad-based economic transformation. For Africa, the goal is not merely to count millionaires, but to build a wealth ecosystem where prosperity is self-reinforcing, where opportunity expands, capital circulates locally, and the continent becomes not just a participant, but a leader, in the global wealth story.”

Top Headlines

© 2025 IPPMEDIA.COM. ALL RIGHTS RESERVED