Why open finance must work for every Tanzanian

As Tanzania accelerates toward a digital economy, the call for open finance is not only timely—it is essential. Across the globe, financial ecosystems are evolving, placing data ownership in the hands of consumers, empowering them to make informed decisions and unlock better financial services.

Tanzania cannot afford to be left behind. However, our path must ensure open finance functions not merely in theory or for the privileged few—but for every Tanzanian, especially those who are underserved.

A recent high-level dialogue in Dar es Salaam—convened by the Bank of Tanzania (BoT), Financial Sector Deepening Tanzania (FSDT), and the Financial Services Registry (FSR), with support from CGAP—could not have been more opportune. It provided a platform for Tanzania to draw insights from Brazil’s groundbreaking transition from open banking to open finance—a move that empowered millions and placed consumer interest at the heart of financial innovation.

Luiz Felipe from Brazil’s Central Bank emphasized a fundamental principle: “The consumer owns their data.” This statement, though technical and legal, is profoundly philosophical—it redefines power dynamics in financial services. In Brazil, this principle became reality through a phased rollout and mandatory participation by major institutions. As Felipe stressed, “The ecosystem wouldn’t work unless all the key players were onboard.”

That kind of commitment made all the difference. Tanzania must take note. Voluntary participation may appear inclusive on paper, but in practice, it often protects established players and leaves consumers with limited options.

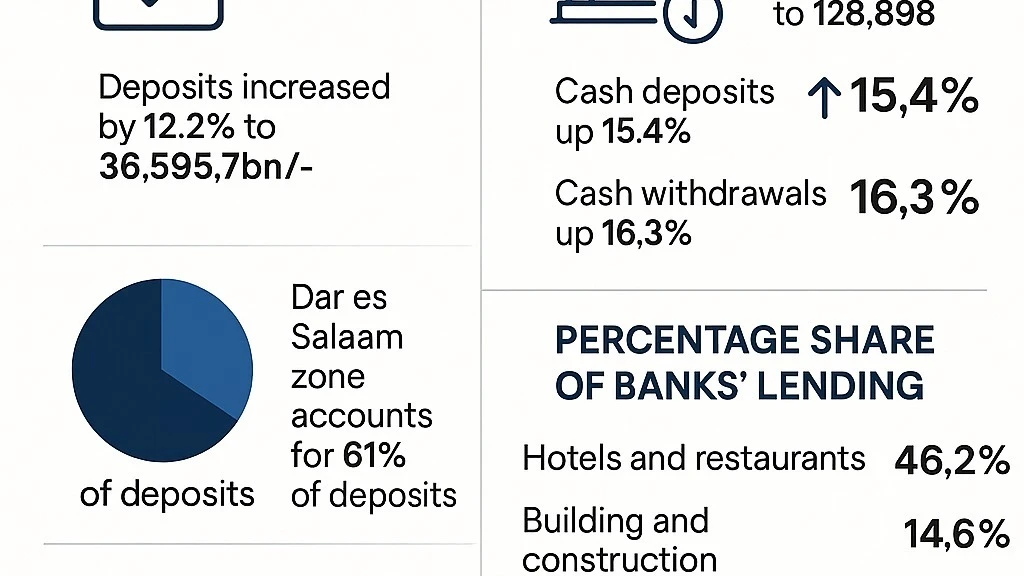

BoT Governor Emmanuel Tutuba praised the thematic focus of the event, highlighting the shift to a cash-lite economy as a cornerstone for building a more inclusive and resilient financial system.

He acknowledged the meaningful progress achieved through mobile money platforms, digital wallets, and homegrown fintech innovations. Still, he underscored the need for coordinated efforts across all stakeholders—government bodies, financial institutions, technology firms, and civil society organizations (CSOs)—to fully realize the digital transition’s potential.

Finance Minister Dr. Mwigulu Nchemba laid out critical national priorities. Among them: ensuring accessible and affordable digital payment solutions to reduce dependence on cash, stimulate productivity, and drive inclusive economic growth. He also emphasized the importance of balancing innovation with robust consumer protection.

The Minister reaffirmed the government’s commitment to fostering a policy and regulatory framework that nurtures responsible financial innovation, safeguards cybersecurity, and guarantees broad access to digital financial services.

India’s story also featured prominently. Rajesh Bansal, CEO of the Reserve Bank Innovation Hub (RBIH), offered a deep dive into India’s remarkable transformation into a digital economy—enabled by Digital Public Infrastructure (DPI).

He outlined a 15-year journey that yielded extraordinary results in financial inclusion and digital uptake.

Access to banking surged from 35 percent of the population in 2011 to over 80 percent in 2024, driven by the Pradhan Mantri Jan-Dhan Yojana (PMJDY), which enabled the opening of 550 million zero-balance accounts—306 million of them for women—amassing deposits worth US$28.54 billion and revolutionizing financial access for marginalized communities.

Bansal also noted the rise in internet penetration—from 251.5 million connections in 2014 to 969.6 million in 2024—providing a strong base for digital services.

India’s fintech ecosystem, too, witnessed exponential growth: from zero unicorns in 2012 to 26 by 2024, including one decacorn valued at over US$10 billion. With a combined market capitalization of US$90 billion, over 10,000 startups, and proactive regulation, India provides a compelling model.

At the core of Tanzania’s strategy must be consumer trust. In a market where many still harbor doubts about digital systems—fueled by fears of fraud, data misuse, or lack of recourse—regulatory clarity is not a luxury. It is a necessity.

As FSDT Executive Director Sosthenes Kewe put it succinctly: “Open finance can be a powerful tool for financial inclusion, but it must be grounded in consumer protection and trust.”

Let’s be candid: the conversation around digital transformation in Tanzania often leaves out the voices that matter most—low-income women, youth, rural entrepreneurs. For open finance to be meaningful, it must prioritize these groups.

It should help a mama lishe secure affordable credit. It should allow a boda boda rider to switch insurance providers effortlessly. And it must protect user data as rigorously as we safeguard bank vaults.

CGAP’s Myra Valenzuela captured the essence: “Open finance is not just about technology. It's about empowering people to access the financial services they need in a fair and transparent manner.” The goal isn’t merely APIs or dashboards. It is equity. It is resilience. It is inclusion.

Tanzania can draw inspiration from India’s DPI model, which unbundles identity, payments, and data sharing. Kenya’s path to interoperability also offers valuable insights. But in the end, we must design a system that fits Tanzania’s realities—a country where cash still dominates, informal lending remains widespread, and data literacy is uneven.

That’s why ongoing work by BoT and its partners to develop a regulatory sandbox, expand digital ID systems, and create a consent framework is so vital. It may not grab headlines, but this behind-the-scenes infrastructure is the plumbing upon which trust and innovation depend.

Nonetheless, formidable challenges remain. Fintech players like Joseph Ndunguru raise an important concern: “The biggest challenge is trust. Consumers need assurance that their data is safe.” This isn’t only a technical issue—it’s a social contract.

Mariam Nyambura, a voice from the mobile money industry, echoes the sentiment: “Interoperability is key. We need to ensure that systems can talk to each other, regardless of provider.” Without true interoperability, we risk erecting new silos with digital labels.

Policy alignment is another crucial dimension. Anna Mwasha from the Ministry of Finance noted, “We are building towards a cash-lite society, and that requires infrastructure, regulation, and a vibrant innovation ecosystem.”

These elements must work in concert. Too often, the emphasis is placed solely on technical infrastructure, neglecting the equally vital social safeguards that prevent exclusion.

As Abdallah Bakari from FSR put it, “We are building the rails. But for the train to move, everyone has to be aligned—regulators, innovators, and consumers.” That alignment demands political will, agile regulation, and above all, an unshakable commitment to fairness.

If we get this right, open finance has the potential to transform Tanzania’s financial landscape. But we must move forward with care, resolve, and empathy. Because at its core, open finance is not about unlocking data—it’s about opening doors.

This article is based on proceedings from the 9th Gilman Rutihinda Memorial Lecture, themed “Driving the Shift Towards a Cash-Lite Economy: Opportunities for Financial Innovation and Inclusion,” recently published by the Bank of Tanzania. The lecture honors the legacy of the late Governor Gilman Rutihinda, whose leadership in financial sector liberalization and market-driven policies laid the groundwork for today’s progress.

Top Headlines

© 2025 IPPMEDIA.COM. ALL RIGHTS RESERVED