Banks record 1.69trn/- net deposits by March 2024

As deposits continue to account for the largest share of their assets for lending businesses, banks recorded a net deposit of 1.69trn/- during the end of March this year, a decrease of more than 50 percent compared to 3.42trn/- recorded during the end of March 2023.

This trend caused by the higher increase of loans issuance than the increase of deposits.

Provisional data by the Bank of Tanzania (BoT) show that the stock of banks deposits increased by 3.4trn/- to 31.42trn/- during the end of March from 27.99trn/- recorded at the end of March last year against an increase of loans by 5.16trn/- to 29.7trn/- from 24.5trn/- respectively.

The sharp increase of lending resulted from improved business environment, which has caused increased demands for new loans by various sectors of the economy.

Bankers say the increased banking assets quality, specifically the rate of Non-Performing Loans (NPLs) has also decreased below regulatory benchmark of five percent, which has increased the banks trust to lend more to the market.

“Demand for credit is expected to remain high, attributable to the improving business environment and supportive policies, public investment in infrastructure, and normalization of the global economy,” BoT said in its monetary policy report for April.

This is also fueled by further decline of overall lending rates, as the central bank reported that rates are expected to continue moderating owing to measures geared towards addressing the structural impediments in the market coupled with low and stable inflation.

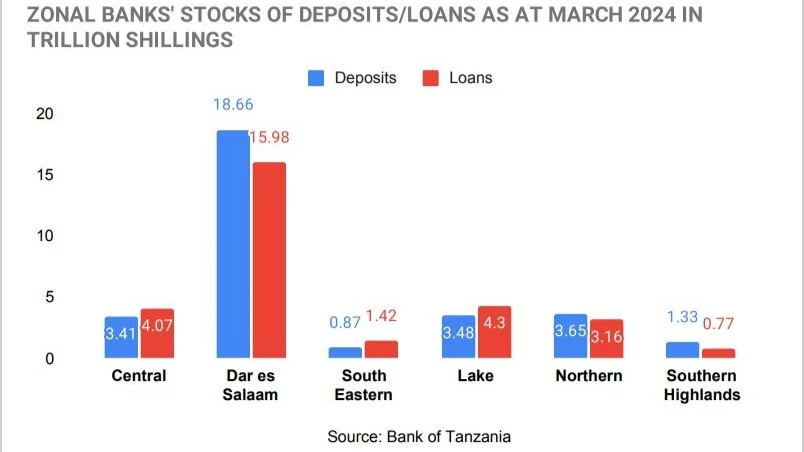

However, the report shows Dar es Salaam northern and southern highland zones of Tanzania recorded positive stock of net deposits, while the remaining zones including Lake and Central recorded a negative net deposits stocks.

The Dar es Salaam Zone, which accounts for 53 percent of total stock of loans and 59 percent of total stock of deposit, recorded a net stock of deposit amounting to 2.7trn/-, as the stock of deposits amounted to 18.6trn/- against loans amounting to 15.9trn/- at the end of March this year.

However, the amount was lower than the net deposit amounting to 3trn/- recorded at the end of March last year and a net deposit of 4.2trn/- recorded at the end of December last year.

According to the central bank’s provisional date, the second zone to recorded net deposit was Southern Highlands which the stock of deposit amounted to 1.33trn/- at the end of March this year, against the stock of loans amounting to 0.77trn/-.

The Northern zone of Tanzania also recorded net banks deposits of nearly 500bn/- during the period, as the stock of deposits at the end of March this year amounted to 3.65trn/- against the stock of loans amounting to 3.16trn/-.

The report shows Lake and central zone of Tanzania mainland recorded a deficit in deposits after the loans issued being less than the amount of mobilized deposits.

In the central zone of Tanzania, which accounts for 10.9 percent of total deposits and 13.7 percent share of total loans; the stock of deposits at the end of March this year amounted to 3.11trn/- but the stock of loans were 4.07trn/-.

The report shows the stock of deposits in Lake Zone amounted to 3.48trn/- while the stock of loans amounted to 4.30trn/- at the end of March this year.

In its monetary policy report for July this year, the Monetary Policy Committee of BoT said the banking sector was liquid, profitable, and adequately capitalized, recording growth in deposits and assets.

The increase in assets was in tandem with deposits, enabled by the agent-banking model, proliferation of financial products, and digital banking services.

At the end of May, the report shows total loans, advances and overdraft amounted to 33.9trn/- while the total deposits of 40trn/-. About 68.3 percent of banks’ loans were extended to personal, trade, agriculture and manufacturing activities.

The expansion of loans was attributable to the improved business environment.

Liquidity in banks was adequate and enough for loan provision, with the ratio of liquid assets to demand liabilities, as well as to total assets hovering above the regulatory requirements.

Asset quality continued to improve, as reflected by the decline in non-performing loans to gross loans (NPL ratio) ratio to 4.4 percent in May 2024 from 5.5 percent in 2023.

“This trend is expected to continue as the economy recovers from the global shocks and banks implement measures to improve the quality of assets,” BoT said in its policy report.

According to the report by Fitch Solutions, after slowing from 24 percent y-o-y at end-2022 to 21.6 percent in June 2023, loan growth by Tanzanian banking sector will continue to soften to 18.0 percent at the end of 2024.

Fitch Solutions also expects 20 percent growth of banks deposits this year from 23 percent last year due to slowdown in the shilling depreciation.

Top Headlines

© 2025 IPPMEDIA.COM. ALL RIGHTS RESERVED