Dar, Mbeya Regions record drop in bank branches over five years

Despite an overall increase in the total number of bank branches across Tanzania, Dar es Salaam and Mbeya were the only regions that recorded a decline in physical outlets over the past five years.

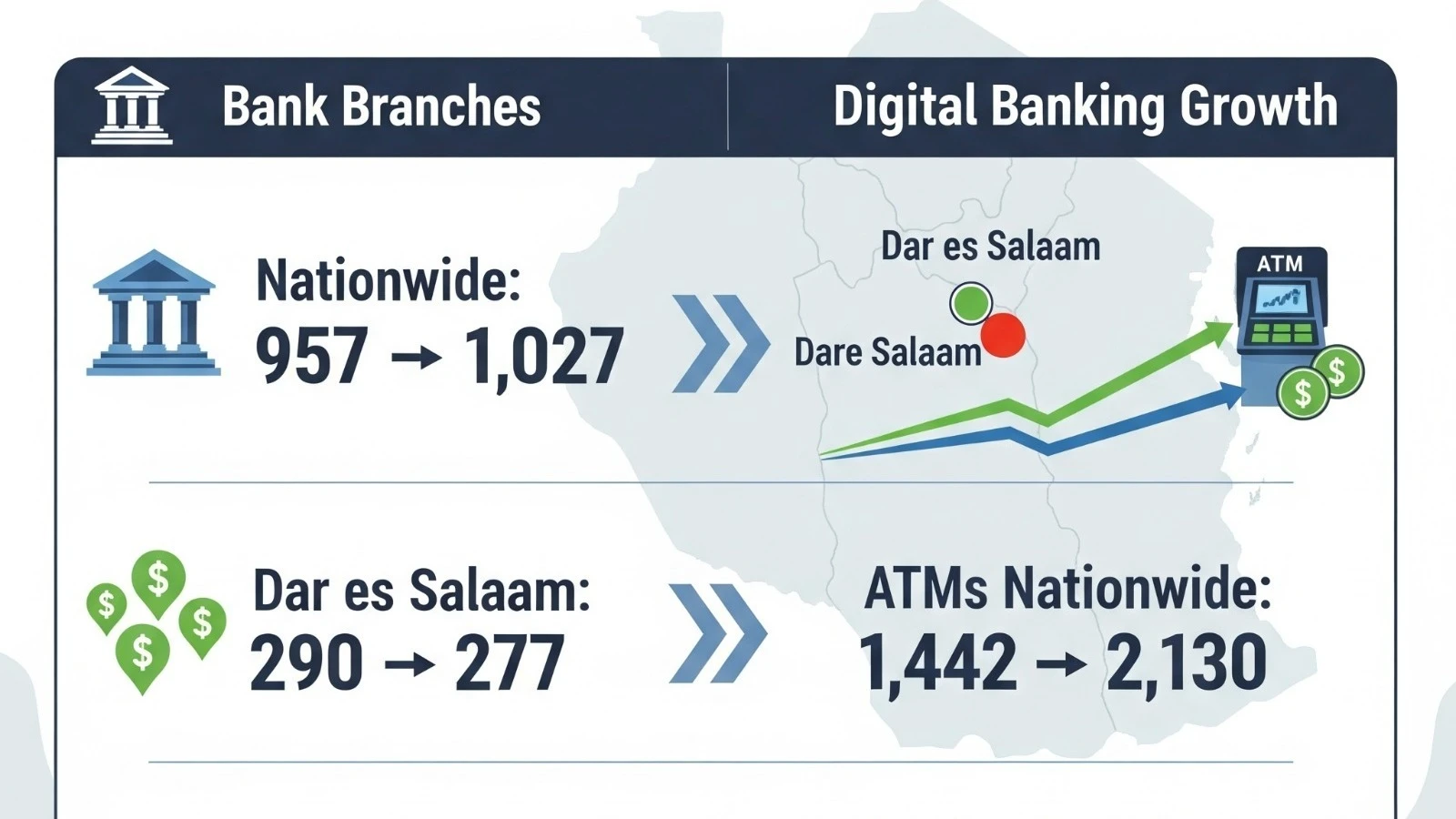

The latest Bank of Tanzania (BoT) financial inclusion report 2024 shows that while the total number of bank branches nationwide rose to 1,027 in 2024 from 957 in 2019, Dar es Salaam saw its branches decrease to 277 from 290, while Mbeya declined to 44 from 46.

Banking analysts attribute the decline in these two regions to sector consolidation, which involved mergers and acquisitions (M&A) as well as the rapid growth of digital banking channels, including internet banking, agency banking and Automated Teller Machines (ATMs).

The report indicates that the number of ATMs nationwide increased to 2,130 in 2024 from 1,442 in 2019. Dar es Salaam led with 706 ATMs, followed by Arusha with 148 and Mwanza with 128 machines, while banking agencies reached 128,089 by the end of 2024.

“From 2019 to 2024, Tanzania’s banking sector experienced a significant trend of consolidation, driven by the BoT’s efforts to strengthen the industry and ensure stability,” said a banking analyst. “The central bank actively encouraged mergers and acquisitions to create a smaller number of healthier, better-capitalized, and more competitive banks. This strategic move addressed a crowded market that previously had many small, undercapitalized, and sometimes struggling institutions.”

During this period, many smaller banks were found to be undercapitalized, posing a risk to the financial system. The BoT’s consolidation strategy aimed to merge weaker institutions with larger, more stable ones, thereby improving their overall capital base and financial resilience. Many consolidated banks subsequently closed branches and invested heavily in digital channels.

Exim Bank Tanzania emerged as a major player in the consolidation trend. In 2019, it acquired UBL Bank Tanzania, followed by First National Bank (FNB) Tanzania in 2022, and most recently, Canara Bank Tanzania in early 2025, with the deal being finalized in 2024. This marked Exim Bank’s third acquisition within six years.

Other notable mergers include the 2019 union of NIC Bank Tanzania and the Commercial Bank of Africa (CBA) to form NCBA Bank Tanzania. This merger created a larger, stronger entity with a more robust capital base and wider reach.

Tanzania Commercial Bank (TCB), formerly TPB Bank, also played a key role. In June 2020, TIB Corporate Bank Limited was merged into TPB, increasing its total assets to over 1trn/-.

Additionally, in 2019, the BoT transferred the assets and liabilities of Bank M Tanzania to Azania Bank. This was followed by a 2020 merger between Mwanga Community Bank, EFC Microfinance Bank, and Hakika Microfinance Bank to form Mwanga Hakika Bank.

In 2021, China Commercial Bank Limited was placed under statutory administration, with all its assets and liabilities transferred to NMB Bank.

In 2023, Access Bank Plc acquired a majority stake in African Banking Corporation (Tanzania). In June 2024, Selcom Tanzania acquired Access Microfinance, which was subsequently rebranded as Selcom Microfinance Bank Tanzania.

This wave of consolidation led to a notable decline in the number of licensed banking institutions in Tanzania, falling from 59 in 2017 to 43 in 2023.

The strategic objective of these mergers and acquisitions has been to create a more resilient, efficient, and competitive financial sector capable of supporting the country’s economic growth and development.

The BoT’s financial inclusion report also highlights growth in bank branches across most regions. Except for Dar es Salaam and Mbeya, the number of branches increased by between one and five, with the exceptions of Coast and Dodoma regions, which together recorded an increase of 18 new branches.

Coast, an emerging industrial hub, recorded the highest growth, with branches increasing to 25 from 14, while Dodoma saw an increase to 48 from 41, driven largely by the relocation of government offices to the national capital.

Other regions with branch increases of five each included Kilimanjaro, Mara, Morogoro, and Mwanza, while Tanga recorded six new branches, ranking third behind Coast and Dodoma.

Kigoma, Simiyu, Singida, and Tabora recorded increases of four branches each, while Shinyanga, Mtwara, Manyara, Kagera, and Geita added three new branches each.

Arusha, Katavi, Njombe, and Unguja each recorded increases of two branches, while Songwe, Ruvuma, and Lindi each added one branch. Pemba, however, saw no net change, with branches decreasing from 11 in 2023 to eight in 2024.

Top Headlines

© 2025 IPPMEDIA.COM. ALL RIGHTS RESERVED