National debt stock declines, over eased external shocks

The national debt stock recorded a monthly decrease of 1.4 percent, reaching US$41,844.1 million at the end of July 2024.

According to Bank of Tanzania (BoT) monthly economic review for August, the decline was largely associated with a decline in the external debt stock, constituting 70.9 percent of the total national debt.

The external debt stock was US$29,685.1 million at the end of July 2024, which is 1.9 percent, lower than the stock recorded at the end of the preceding month.

The decline was attributed to a decline in private sector external debt.

External loans disbursed in July 2024 amounted to US$87.0 million, primarily to the central government. During the month, external debt service totalled US$45.3 million, of which US$34.2 million was for principal repayment, and the remainder was for interest payments.

External debt owed to the central government continued to account for the largest share of the external debt stock, at 83.2 percent.

The composition of the external debt stock by creditor category remained unchanged from the previous month and the corresponding period in 2023, with multilateral institutions continuing to dominate the portfolio.

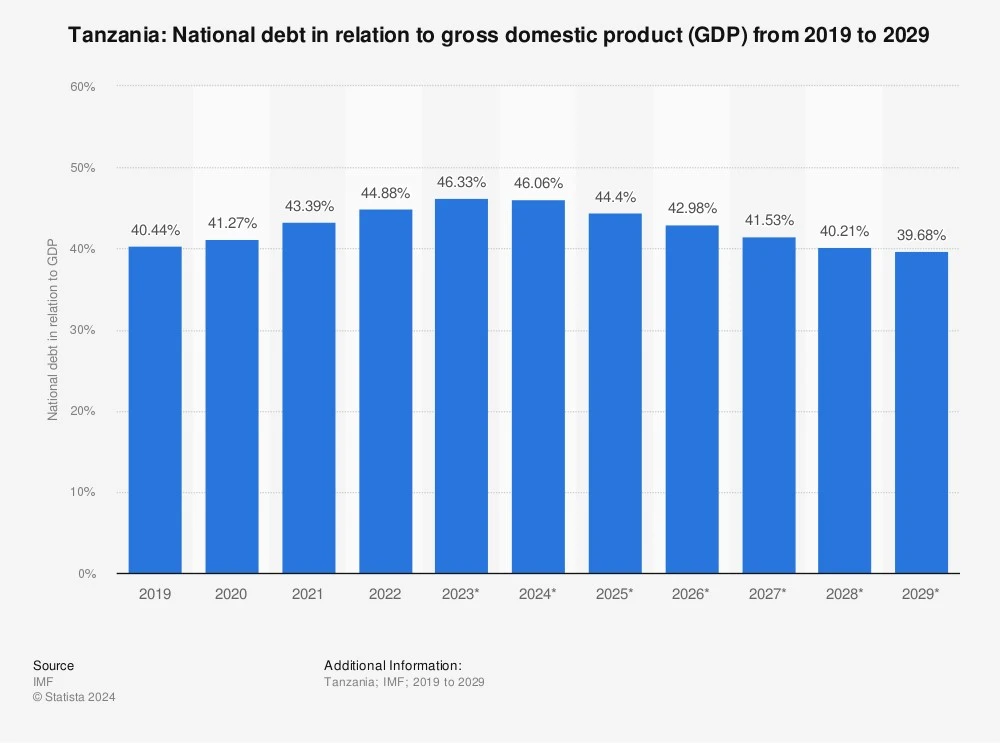

Tabling the 2024/25 budget to the parliament in June, finance minister Dr Mwigulu Nchemba said the Debt Sustainability Assessment (DSA) conducted in December 2023, all external debt burden indicators continue to remain below the established thresholds in the baseline, affirming the sustainability of Tanzania's debt in the medium and long term.

The findings of the 2023 DSA reveal that the present value (PV) of both external public debt to GDP (18.4 percent) and public debt to GDP (33.3 percent) ratios remain below the threshold of 40 percent and 55 percent respectively in 2023/24.

“This positive outcome is attributed to a stable macroeconomic outlook, supported by conducive government policies, and an efficient debt management strategy,” he said.

The minister added that as at March 2024, the national debt amounted to 91trn/- of which 60.95trn/- was external debt and 30.7trn/- was domestic debt, which was an increase of 19trn/- since the sixth phase government took power in 2021.

The BoT review further says, transportation and telecommunications economic activities also continued to hold the largest portion of the disbursed outstanding external debt, followed by social welfare and education.

The outstanding external debt maintained its currency composition, with the US dollar holding the largest share at 66.8 percent.

Domestic debt stock was 32,465.1bn/- at the end of July 2024, an increase of 526.9bn/- from the previous month’s position, largely attributed to increased utilization of the overdraft facility.

Treasury bonds continued to account for the largest share of the debt stock, at 76.7 percent, while commercial banks and social security schemes remained the leading creditors to the government.

During the month under review, the Government secured 372.1bn/- from the domestic market to fund the budget, of which 230.1bn/- was through Treasury bonds and 142bn/- billion was through Treasury bills.

Domestic debt service payments during the month amounted to 250.4bn/-, consisting of 32.5bn/- in principal repayments and 217.9bn/- in interest payments.

The outstanding domestic debt of selected StateOwned Enterprises (SOEs) was 76bn/- at the end of July 2024, an increase of 2.7bn/- from the position recorded at the end of the previous month.

The primary contributor was the Dar es Salaam Water and Sewerage Authority (DAWASA), whose debt grew by 2.8bn/-.

According to the International Monetary Fund (IMF), the Tanzania’s Debt Sustainability Analysis (DSA) indicates that its risk of external debt distress remains moderate.

“Continued lingering effects of the spillovers from the war in Ukraine have marginally weakened Tanzania’s ability to service its external debt,” says IMF.

“To maintain current fiscal and debt sustainability, in line with the IMF Extended Credit Facility (ECF) objectives, the authorities should improve revenue mobilization and public investment management, including by selecting only investment projects with clear socioeconomic payoffs. Building resilience to climate change is also important to preserve debt sustainability amid climate change effects.”

Top Headlines

© 2026 IPPMEDIA.COM. ALL RIGHTS RESERVED