Sumaye: Review term limits for bank CEOs

FORMER premier Fredrick Sumaye has expressed the need for the Bank of Tanzania to review term limits for top cadres of commercial banks where the government has shares.

The veteran leader received cheerful applause from shareholders attending the CRDB Bank annual general meeting, saying that CRDB Bank and NMB Bank are important to the economy of this country.

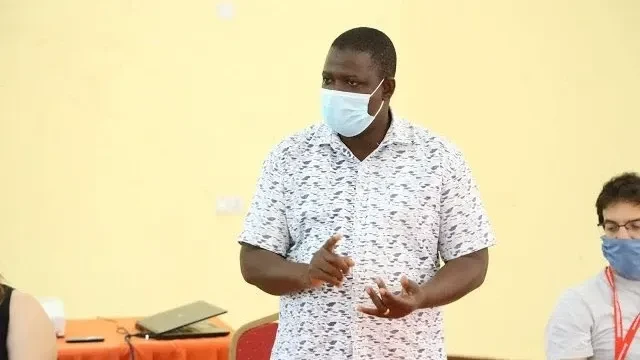

Expressing appreciation for competent bank leadership of the managing director Abdulmajid Nsekela, he pointed at the various reforms conducted in the country’s largest bank, since he took over from the founding CEO, Dr Charles Kimei.

Sumaye made the remarks after the presentations of the bank’s board of directors’ report, the audited financial statements and proposed dividends for the year ended in December 2023, which all indicated strengthening of CRDB Bank and strong growth of shareholders investments.

Fredrick Nshekanabo, the bank’s chief finance officer, said in the report that the bank and its subsidiaries’ balance sheets grew to 13.3trn/- at the end of 2023, representing a 121 percent growth from 2018, when the current CEO took over.

Strong growth was recorded in various indicators, including 560 percent growth of net profit in five years to 422bn/-, resulting in growth of dividends’ growth by 900 percent to 50/-per share in 2023, from 5/- in 2018.

The former premier raised a note of concern, asking the Bank of Tanzania (BoT) to review regulations that disallow bank CEOs to extend their functions beyond the ten years limit, when examining the report due to the fact that it showrf strong growth of special subsidiaries, namely CRDB Congo, CRDB Bank Foundation and CRDB Insurance Co. Ltd.

Sumaye, a founding shareholder with the bank, said Nsekela has shown excellent capacity in leading the bank to achieve the record breaking performances, well beyond earlier achievements since the bank was established.

“Dr Charles Kimei, the former managing director took this bank from its inception, building it to reach where Nsekela took over,’ he stated, recalling that he once told ex-BoT governor Prof Florens Luoga, who was at the meeting, that banks are sensitive institutions where a small mistake can occasion a huge impact.

“For the largest banks such as CRDB and NMB, if their managing directors have good visions, they should be left to implement them without time limitations.”

.“I know that BoT has a limitation of ten years for bank CEOs to serve. I think it should authorize some CEOs of the banks to serve beyond the limitation of ten years to allow them to fulfill their dreams,” he told the members of the AGM, in the presence of senior BoT officials.

Sumaye who served as premier from late 1995 to late 2005 under the late Benjamin Mkapa. the country’s third president, said it was necessary to retain visionary leaders for the prosperity of the banking sector and the wider economy.

The former premier appreciated CRDB Bank’s effort in extending service delivery not just in the domestic market, but also in neighbouring countries. He pointed at the Democratic Republic of Congo (DRC) where CRDB Bank presence opens up economic opportunities for the Tanzanian business community.

Advising caution when implementing the bank’s expansion programme, he expressed satisfaction with CRDB Bank’s positive outlook on the development of the technology. The bank needs to take precautions on investment in physical branches and their future productivity is limited in scope.

”We need to observe the long term benefits,” he said, noting that as familiarity with the use of technology grows, banks should invest in a few branches and enhance the use of agents.

Supporting the views by the former premier, Dr Charles Kimei, the MP for Vunjo, said Nsekela has managed to fit his shoes to excess, which has led into strong growth for CRDB Bank.

It was during Sumaye’s time as premier that various bank sector institutions came up with the splitting and privatization of the former National Bank of Commerce as well as the privatisation of the former Cooperative and Rural Development Bank (CRDB).

Speaking during the AGM, Nsekela said the new business strategy remained the major driver of success of CRDB Bank and created a roadmap to improve operations.

Nsekela said CRDB has invested heavily in financial inclusion among small businesses, specifically youths and women, through iMbeju programme, managed by CRDB Bank Foundation, while partnering with bilateral and multilateral institutions to finance development projects across the country.

He said of future plans as directed at ensuring the bank and its established subsidiaries improve services to customers through enhanced investment in innovative digital solutions, proper management of risks and good governance.

During his assumption of office on October 10, 2018, Nsekela listed five priorities including improving the service delivery system, improving professionalism and competence among employees, investing in modern technology and expansion of business activities.

Top Headlines

© 2025 IPPMEDIA.COM. ALL RIGHTS RESERVED