How Tanzania can benefit from 'global soft power' index

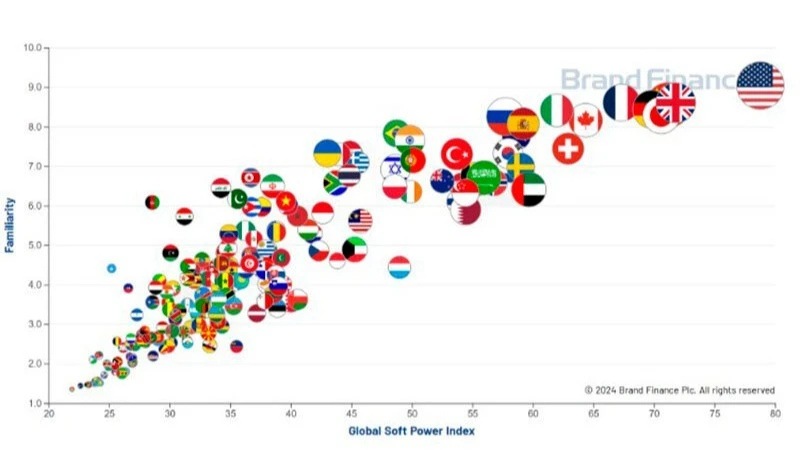

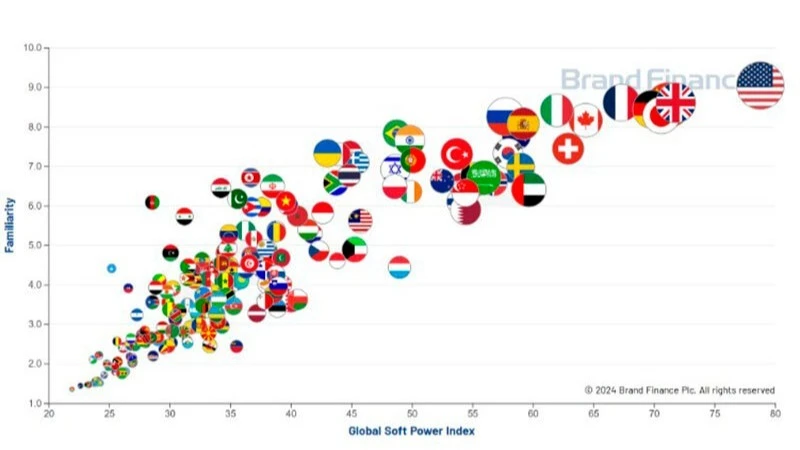

IN Global Soft Power Index (GSPI) 2025, which measures the shifting and dynamic influence of nations, driven by their leaders, cultures and global politics, Tanzania ranks 95th out of all 193 member states of the United Nations, according to Jamie Hyman, Brand Finance Plc Global Head of Communications.

Hyman says the firm recognises each country's performance across each dimension of the GSPI and awards metaphorical ‘medals’ for the top three performers in each category. In this year’s rankings, the top three performers with their scores on a scale of 0-100 in brackets are the United States (79.5), China (72.8), and the United Kingdom (72.4). The bottom three performers with their scores in brackets are Tuvalu (20.0), Vanuatu (19.3), and Kiribati (18.8).

Brand Finance Plc defines soft power as a nation’s ability to influence others through attraction and persuasion (through culture, business or diplomacy) rather than coercion - that is the use of military force - or economic sanctions.

Brand Finance is a chartered accountancy firm regulated by England and Wales Institute of Chartered Accountants. Established in 1996, the firm was the first brand valuation consultancy to join the International Valuation Standards Council.

The GSPI report says this year’s results are based on a global sample of 173,602 participants in 102 markets between September 19 and November 22, with targeted market top-ups taking place from November 25 to December 9, 2024 to ensure robust global coverage and scores for all nation brands.

The firm has been conducting an annual nation brands study on the world’s most valuable and strongest nation brands for 21 years, and provides key benchmarks for diplomats, tourism boards, trade agencies, nation brand consultants and managers. It says its GSPI is the world’s most comprehensive research study on perceptions of nation brands.

Its evaluation provides an all-round view of perceptions of nation brands, and understanding those perceptions is central to national, regional, city, and corporate brands to achieve success internationally, thus allowing to identify strengths and weaknesses, and improve growth strategies.

“The stronger the nation’s soft power, the greater its ability to attract investments, market its products and services, promote tourism, and invite talent,” says Brand Finance.

Designed for policymakers, strategists, marketing professionals, and diplomacy leaders, the Brand Finance report provides a roadmap to navigate a global nation branding landscape.

“By integrating perception research with financial data, you gain the insight to get ahead of others in the global arena – grow soft power and devise successful strategies to attract investment, trade, talent, and tourism,” the report says.

Brand Finance Chairman David Haigh poses the following fundamental questions a nation can ask itself regarding the global nation branding landscape.

“What do we stand for as a nation? What do our stakeholders—whether they be citizens, investors, or international partners—value most about us? How can we craft a narrative that resonates with these audiences and equips us to weather the inevitable headwinds of global competition?”

He says the answers to those questions are central to managing perceptions and building a sustainable and compelling vision for the future. “Soft power is no longer a passive asset, but a competitive advantage that must be nurtured actively,” he adds. Haigh suggests that “success requires a long-term commitment to understand how others perceive us and align those perceptions with our strategic goals.”

While higher scores show more international impact and stronger perceptions, lower scores show less international impact and weaker perceptions.

Each surveyed nation is measured against 1) three key performance indicators (KPIs): familiarity (how well a nation is known), reputation (how positively a nation is regarded) and influence (how much a nation is perceived to influence other nations); 2) eight soft power pillars, and 35 nation brand attributes, and 3) recommendation measurement (a nation’s ability to attract investment, trade, talent, and tourism).

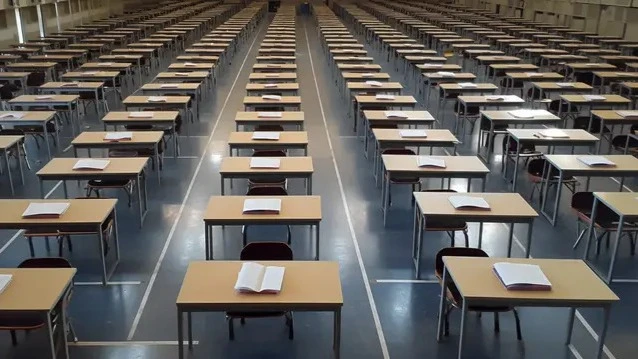

The eight pillars (which are subdivided into 35 attributes) are business and trade, international relations, education and science, culture and heritage, governance, media and communication, sustainable future, and people and values.

Brand Finance Place Branding Director Konrad Jagodzinski says the United States maintains its position at the top of the GSPI, scoring 79.5 out of 100. “It leads in familiarity and influence and ranks first in three of the eight soft power pillars: international relations, education and science, and media and communications.”

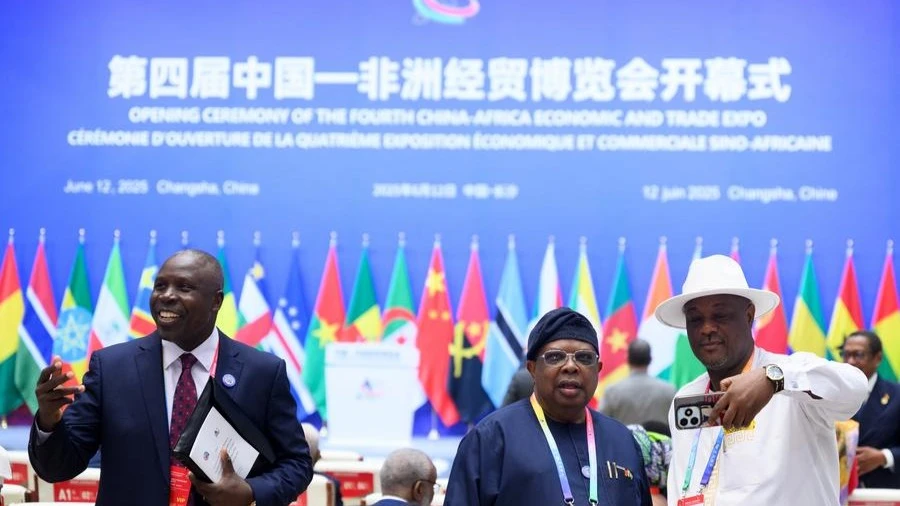

China shows remarkable progress in soft power, says Brand Finance Chairman Haigh. He suggests that 2025 is a big year for China’s nation brand as it is now the second-most powerful nation in the world in terms of soft power, surpassing the United Kingdom and second only to the US.

“China’s second-place spot in the ranking is its highest performance since Brand Finance began researching perceptions of nation brands. Its ascent is not due to luck, but deliberate and multifaceted efforts to address weaknesses in how the country is perceived. The data indicates the strategy is working, as China’s reputation has climbed to 27th rank, up from 56th in 2021.” China moved up 29 places.

Haigh says last year, China’s nation brand experienced notable growth across six of eight soft power pillars and in two-thirds of measured attributes. Its growth highlights how improved perceptions across a range of economic, cultural, and social metrics are driving China’s soft power.

Jagodzinski says China has climbed to second place in the GSPI with a score of 72.8 out of 100, achieving its highest position to date and surpassing the UK for the first time. “This improvement can be attributed to strategic efforts to enhance its global image, including the Belt and Road infrastructure projects, a renewed focus on sustainable development, stronger product brands, and the country's reopening to visitors after the Covid-19 pandemic.”

He, too, attributes China’s success to its addressing perceptual weaknesses, particularly in the country’s people and values, up 18 positions this year. “Overall, five of the lowest-ranked attributes from the previous year show the most significant increases: ‘generous’ (+27 ranks), ‘friendly’ (+25 ranks), ‘good relations with other countries’ (+24 ranks), ‘easy to communicate with’ (+20 ranks), and ‘fun’ (+15 ranks).” These efforts, Jagodzinski says, have helped to bolster China’s global perceptions.

If Tanzania also improves in the categories it has underperformed, it will eventually become a top performer, especially in the following with scores in brackets on a scale of 0-10: 1) two key KPIs: familiarity (3.7), influence (3.3), and 2) eight soft power pillars: business & trade (3.0), international relations (3.0), education & science (2.3), culture & heritage (3.1), governance (2.7), media & communication (2.9), sustainable future (3.0), and people & values (3.9). In these attributes Tanzania has scored below average, but above average only in reputation (5.5).

Top Headlines

© 2025 IPPMEDIA.COM. ALL RIGHTS RESERVED